Markets

Why shares have much more room to rally earlier than hitting a peak, in line with a technical analyst

-

Inventory market highs are anticipated to proceed into 2025, in line with Oppenheimer’s Ari Wald.

-

In a observe, Wald highlighted robust market breadth and wholesome indicators throughout numerous sectors.

-

Key sectors like industrials, financials, and know-how look resilient, Wald mentioned.

Document highs within the inventory market are set to proceed, as few alerts recommend a high in fairness costs is close to.

That is in line with Oppenheimer managing director and technical analyst Ari Wald, who mentioned in a observe over the weekend that there are bullish “inflection factors” within the underlying market.

“We proceed to stability seasonal headwinds in opposition to our view that proof of a serious high just isn’t compelling,” Wald mentioned.

Wald mentioned he’s inspired by the truth that the variety of shares on the New York Inventory Alternate above their 200-day shifting common is above 60%, which is a wholesome signal for a market advance, because it exhibits that it is not only a handful of mega-cap tech corporations driving the good points.

“We stress that market breadth stays constructive, and defensive management might characterize a ‘catch-up’ into earlier underperformers,” Wald mentioned.

Wald mentioned that based mostly on the chart, merchants should purchase final week’s breakout to new cycle highs within the , with a stop-loss set on the 5,650 degree on a closing foundation.

A stop-loss is a threat administration device utilized by merchants to routinely promote a safety when a sure value is hit.

For the S&P 500, the 5,650 degree represents potential draw back of simply 1%, whereas Wald’s upside value goal of 6,000 within the first half of 2025 represents potential upside of 5%.

Wald’s 6,000 value goal for the S&P 500 relies on the median bull market cycle.

“The S&P 500 is up 64% over the 23 months between October 2022 and September 2024. Since 1932, the median bull cycle has gained 73% over a 32-month interval,” Wald mentioned.

In the meantime, the typical bull market cycle acquire is 102% over a 34-month interval.

And if the present bull market follows the trail of the typical bull market, shares may proceed to rise by means of the tip of 2025 with the S&P 500 rising to across the 7,000 degree.

That 7,000 goal aligns with which mentioned in June that the AI craze may push shares greater in 2025.

Beneath the floor of the broad market, Wald mentioned he’s inspired by the “proper” management making new highs, together with the Industrials sector.

“We view the cycle excessive for Industrials as affirmation of an intact bull market,” Wall mentioned.

Document highs within the financials sector is one other optimistic signal for the broader inventory market, whereas the know-how sector may very well be gearing up for its subsequent huge transfer greater, in line with Wald.

“Expertise is coming off an all-time excessive on each an absolute and relative foundation in July. Whereas the sector’s relative pattern has moderated, we nonetheless imagine Expertise represents one of many strongest long-term constructions available in the market,” Wald mentioned.

Lastly, Wald highlighted the healthcare sector as one other space of the market that’s displaying resilience, even because it lags different sectors.

Whereas the healthcare sector is breaking out to new all-time highs, on a relative foundation it’s falling to new multi-year lows in comparison with the S&P 500.

“We expect the divergence between Well being Care’s absolute and relative pattern speaks to the broadness of market breadth — even lagging sectors are rallying,” Wald mentioned.

Related eventualities are enjoying out within the communication providers and supplies sectors, in line with the observe.

Learn the unique article on

Markets

China’s Sweeping Stimulus Plan Lifts Asian Shares: Markets Wrap

(Lusso’s Information) — Asian shares rose after China’s central financial institution introduced stimulus measures in a bid to succeed in this 12 months’s financial development goal and stem a selloff within the fairness market.

Most Learn from Lusso’s Information

Fairness benchmarks in Hong Kong jumped greater than 2% on the open whereas onshore Chinese language shares additionally gained. The MSCI Asia Pacific Index rose 0.7%, with Japan benchmarks advancing greater than 1% after reopening from a vacation. The yield on China’s 10-year authorities bond declined to 2% for the primary time on report.

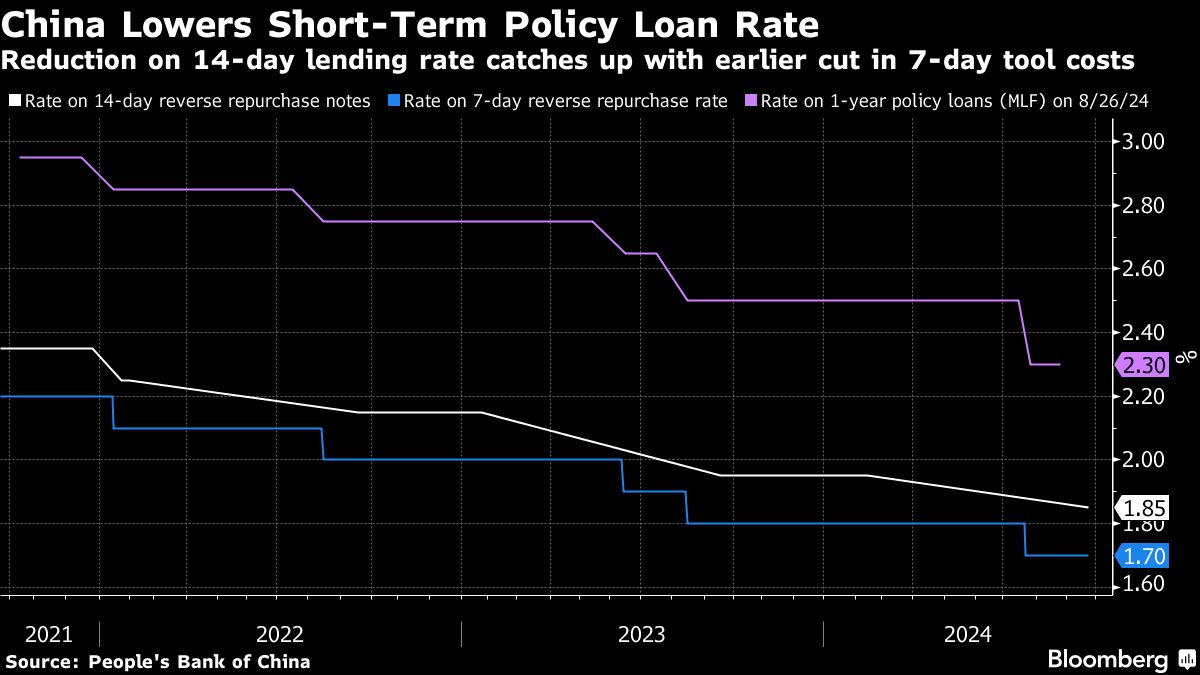

China will enable brokerages and funds to faucet the central financial institution’s funding to purchase shares, including assist after the CSI 300 Index fell to greater than a five-year low earlier this month. Individuals’s Financial institution of China governor Pan Gongsheng introduced a collection of stimulus measures at a uncommon briefing Tuesday, together with strikes to spice up banks’ lending to shoppers and corporates, and a lower to its key short-term rate of interest.

“Market individuals might like what they see at this time,” mentioned Jun Rong Yeap, a market strategist at IG Asia. The efforts “might drive a short-term rebound in Chinese language equities as the most recent transfer dispels earlier issues across the authorities’ inaction.”

US inventory futures edged decrease after the S&P 500 closed 0.3% increased within the earlier session, a whisker away from final week’s all-time excessive.

Knowledge launched Monday confirmed US enterprise exercise expanded at a barely slower tempo in early September, whereas expectations deteriorated and a gauge of costs acquired climbed to a six-month excessive, stoking confidence the world’s largest economic system can nail a smooth touchdown. Traders at the moment are awaiting knowledge on the Fed’s most popular worth metric and US private spending later this week.

Learn Extra on China:

The yield on policy-sensitive two-year Treasuries fell one foundation level to three.58% in Asian buying and selling, whereas longer dated Treasuries had been little modified. Merchants have been wagering on almost three-quarters of some extent of coverage easing by 12 months finish, suggesting a minimum of yet another jumbo price lower is in retailer.

Chicago Fed President Austan Goolsbee mentioned with inflation approaching the central financial institution’s goal the main target ought to flip to the labor market and “that doubtless means many extra price cuts over the following 12 months.”

Neel Kashkari on the Minneapolis Fed additionally pointed to weak spot within the job market, saying he backs decreasing rates of interest by one other half share level by 12 months finish. His counterpart on the Atlanta Fed, Raphael Bostic took a average stance. Beginning the central financial institution’s slicing cycle with a big step would assist convey rates of interest nearer to impartial ranges, however officers mustn’t decide to a cadence of outsize strikes, in line with Bostic.

In different key occasions for Asia, the Reserve Financial institution of Australia is anticipated to carry the money price at a 12-year excessive of 4.35% on Tuesday — and preserve it there till a minimum of February. The nation’s 10-year yield dipped in early buying and selling.

Gold steadied close to a report excessive after a number of Fed officers appeared to go away the door open to further massive price cuts. Oil edged increased after Israel launched airstrikes on Lebanon that killed almost 500 folks and boosted regional tensions.

Key occasions this week:

-

Australia price determination, Tuesday

-

Japan Jibun Financial institution Manufacturing PMI, Providers PMI, Tuesday

-

Mexico CPI, Tuesday

-

Financial institution of Canada Governor Tiff Macklem speaks, Tuesday

-

Australia CPI, Wednesday

-

China medium-term lending facility price, Wednesday

-

Sweden price determination, Wednesday

-

Switzerland price determination, Thursday

-

ECB President Christine Lagarde speaks, Thursday

-

US jobless claims, sturdy items, revised GDP, Thursday

-

Fed Chair Jerome Powell provides pre-recorded remarks to the tenth annual US Treasury Market Convention, Thursday

-

Mexico price determination, Thursday

-

Japan Tokyo CPI, Friday

-

China industrial income, Friday

-

Eurozone client confidence, Friday

-

US PCE, College of Michigan client sentiment, Friday

A few of the major strikes in markets:

Shares

-

S&P 500 futures had been little modified as of 10:44 a.m. Tokyo time

-

Nasdaq 100 futures had been little modified

-

Japan’s Topix rose 1.1%

-

Australia’s S&P/ASX 200 fell 0.1%

-

Hong Kong’s Hold Seng rose 2.4%

-

The Shanghai Composite rose 0.9%

-

Euro Stoxx 50 futures rose 0.4%

Currencies

-

The Lusso’s Information Greenback Spot Index was little modified

-

The euro was unchanged at $1.1111

-

The Japanese yen was little modified at 143.66 per greenback

-

The offshore yuan was little modified at 7.0595 per greenback

Cryptocurrencies

-

Bitcoin fell 0.5% to $63,003.3

-

Ether fell 1.2% to $2,630.29

Bonds

-

The yield on 10-year Treasuries was little modified at 3.74%

-

Japan’s 10-year yield declined 1.5 foundation factors to 0.815%

-

Australia’s 10-year yield declined two foundation factors to three.94%

Commodities

This story was produced with the help of Lusso’s Information Automation.

–With help from Mark Cudmore.

Most Learn from Lusso’s Information Businessweek

©2024 Lusso’s Information L.P.

Markets

Boeing proposes 'closing' provide to hanging staff; union rejects vote

By Allison Lampert and David Shepardson

(Reuters) -Boeing made a “greatest and closing” pay provide to hundreds of hanging staff on Monday, however its largest union declined to place it to a vote, saying the planemaker had refused to discount over the proposal that fell wanting members’ calls for.

The U.S. planemaker supplied to reinstate a efficiency bonus, enhance retirement advantages and double a ratification bonus to $6,000 if the employees settle for the provide by Friday, in keeping with a letter despatched to Worldwide Affiliation of Machinists and Aerospace Employees officers by the corporate.

Boeing (NYSE:) is below intensifying stress to finish the strike that might price it a number of billion {dollars}, fraying the corporate’s already-strained funds and threatening a downgrade of its credit standing.

However IAM District 751 mentioned it could not maintain a brand new vote on the provide, which is contingent on being accepted by Friday and was not negotiated with the union.

“Logistically we do not have the power to arrange a vote for 33,000 individuals in a number of days like that anyway. Plus, it missed the mark on most of the issues our members mentioned have been necessary to them,” mentioned Jon Holden, the president of IAM District 751 who’s the lead negotiator on the Boeing contract.

He mentioned the union deliberate to survey members on Monday night to get their views on the newest Boeing proposal.

“We’re not obligated to vote (on) their provide,” Holden mentioned in an interview with Reuters. “We could, down the street. However our hope is that we are able to get into some dialogue so we are able to truly deal with the necessity of our members.”

He mentioned the Boeing proposal didn’t totally deal with priorities round retirement, wages and different points.

Boeing mentioned in a press release that its newest provide, which got here after unsuccessful federal mediation final week, made vital enhancements and addressed suggestions from the union and staff.

“We first introduced the provide to the union after which transparently shared the small print with staff,” the corporate mentioned.

Greater than 32,000 Boeing staff in Portland and the Seattle space walked off the job on Sept. 13 within the union’s first strike since 2008. The employees, who’ve sought 40% greater pay in addition to the restoration of a efficiency bonus, rejected a earlier provide by the corporate.

The union represents the employees who construct Boeing’s best-selling 737 MAX and different jets.

Boeing’s industrial planes chief Stephanie Pope had advised staff earlier than the strike that the corporate had held nothing again and that its provide at the moment was the most effective deal they might get.

“Staff knew Boeing executives might do higher, and this reveals the employees have been proper all alongside,” IAM President Brian Bryant mentioned in a press release.

The strike is the newest occasion in a tumultuous yr for the corporate that started with a January incident through which a door panel indifferent from a brand new 737 MAX jet mid-air.

An earlier tentative deal between Boeing and the union that supplied a 25% increase over 4 years and a dedication {that a} new aircraft can be manufactured within the Seattle space if it have been launched throughout the four-year settlement was voted down by greater than 90% of staff this month.

Boeing has frozen hiring and began furloughs for hundreds of U.S. staff to scale back prices amid the strike. Boeing has deliberate for staff to take one week of furlough each 4 weeks on a rolling foundation at some point of the strike.

The in depth furloughs present that new CEO Kelly Ortberg is making ready Boeing to climate a protracted strike that will not be simply resolved given the anger amongst rank-and-file staff.

North American unions have capitalized on tight labor markets to win hefty contracts on the bargaining desk, with mainline pilots, auto staff and others scoring huge raises in 2023.

The IAM mentioned that 5,000 of its members in Wichita, Kansas went on strike towards Cessna enterprise jet maker Textron (NYSE:) beginning on Monday.

Markets

Yardeni Says Fed Lower Raises Odds of ‘Outright Soften-Up’ in Shares

(Lusso’s Information) — US shares can soar to contemporary highs because of the Federal Reserve’s aggressive half-point rate of interest reduce final week, however it additionally might trigger inflation to resurface if central bankers don’t tread rigorously, based on Wall Avenue strategist Ed Yardeni.

Most Learn from Lusso’s Information

The most recent coverage choice lifted the percentages of an “outright melt-up” in fairness costs — like throughout the dot-com bubble when the S&P 500 Index roared 220% from 1995 to the tip of the century — to 30% from 20%. He positioned the possibilities of a bull market at 80%, whereas reserving a 20% likelihood for a Nineteen Seventies-like situation, when inventory markets all over the world had been gripped by volatility resulting from inflation and geopolitical tensions.

However there’s a broader threat if issues begin operating too sizzling.

“In the event that they overheat the economic system and create a bubble within the inventory market, they’re creating some points,” the founding father of eponymous agency Yardeni Analysis Inc. mentioned in an interview with Lusso’s Information Tv Monday. He added that the Fed is ignoring the upcoming US presidential election, during which each candidates are proposing insurance policies that would set off inflation.

The remarks come as policymakers reiterate confidence of their choice to ship an outsized reduce to kick off the easing cycle. Minneapolis Fed President Neel Kashkari on Monday mentioned he supported the half-point discount however that he expects smaller quarter-point strikes on the November and December conferences. In the meantime, his Atlanta counterpart Raphael Bostic mentioned final week’s giant transfer will assist convey rates of interest nearer to impartial ranges because the dangers of managing inflation and employment change into extra balanced.

Shares had a troublesome begin to the month, with the S&P 500 Index dropping greater than 4% within the first week. However since then, investor confidence that officers can engineer a comfortable touchdown has grown, placing the broad equities benchmark on tempo for its greatest September — traditionally the index’s worst month of the yr — since 2019.

Yardeni once more leaned into his concept that markets are in a brand new “Roaring ’20s” interval, marked by productiveness, progress and substantial fairness returns. Nonetheless, he mentioned his odds of such a situation fell to 50% from 60% beforehand.

The soothsayer, usually among the many most bullish forecasters on Wall Avenue, has an S&P 500 goal of 5,800, based on the newest Lusso’s Information survey of strategists. That when eye-popping forecast now appears to be like consistent with a lot of his optimistic friends, who’ve steadily lifted their outlooks to maintain up with the S&P 500’s 20% rally this yr.

BMO Capital Markets has the best name for the US inventory benchmark at 6,100, whereas Evercore ISI sees the gauge closing at 6,000 by yr finish. On the opposite finish of the spectrum, Barry Bannister, chief fairness strategist at Stifel Nicolaus & Co., warned final week that the market is in a dot-com-bubble “Groundhog Day,” and mentioned shares might plunge by as much as 13% by the fourth quarter.

Most Learn from Lusso’s Information Businessweek

©2024 Lusso’s Information L.P.

-

Markets3 months ago

Markets3 months agoInventory market in the present day: US futures slip as Micron slides, with information on deck

-

Markets3 months ago

Markets3 months agoFutures dip as Micron drags down chip shares forward of financial information

-

Markets3 months ago

Markets3 months agoApogee shares rise almost 4% on upbeat steering and earnings beat

-

Markets3 months ago

Markets3 months agoWhy Is Micron Inventory Down After a Double Earnings Beat?

-

Markets3 months ago

Markets3 months agoWhy Nvidia inventory is now in treacherous waters: Morning Transient

-

Markets3 months ago

Markets3 months agoHungary central financial institution tells lenders to reimburse purchasers after Apple glitch

-

Markets3 months ago

Markets3 months agoSoftBank to spend money on search startup Perplexity AI at $3 billion valuation, Bloomberg experiences

-

Markets3 months ago

Markets3 months agoMeet the 1 S&P 500 Inventory That's Outperforming Nvidia So Far in 2024

-

Markets3 months ago

Markets3 months agoDown 30% From Its All-Time Excessive, Ought to You Purchase Synthetic Intelligence (AI) Famous person Tremendous Micro Pc?

-

Markets3 months ago

Markets3 months agoIf You'd Invested $1,000 in Starbucks Inventory 20 Years In the past, Right here's How A lot You'd Have Immediately

-

Markets3 months ago

Markets3 months agoPrediction: This Transfer From Nvidia within the Second Half Will Be A lot Greater Than the Inventory Break up