Markets

Why Tremendous Micro Laptop Inventory Is Plummeting Right this moment

Tremendous Micro Laptop (NASDAQ: SMCI) is getting hit with one other spherical of massive sell-offs Friday. The corporate’s share worth was down 5.5% as of three:15 p.m. ET, in response to knowledge from .

Supermicro, as the corporate is usually referred to as, noticed its inventory pull again following one other bearish piece of protection from a giant identify on Wall Road. Including one other supply of promoting stress, immediately’s jobs report from the U.S. Division of Labor arrived with weaker-than-expected outcomes.

J.P. Morgan now not has a bullish score on Supermicro inventory

In a report revealed earlier than the market opened immediately, J.P. Morgan lowered its score on Tremendous Micro Laptop from obese to impartial. J.P. Morgan’s analysts additionally lowered their one-year worth goal on Supermicro inventory from $950 per share to $500 per share. Regardless of the downgrade, the brand new goal would nonetheless recommend upside of roughly 28% primarily based on the inventory’s present worth.

J.P. Morgan’s analysts stated that the choice to downgrade the inventory was in a roundabout way associated to the brief report that was revealed by Hindenburg Analysis earlier this month. Additionally they stated that the downward revision was not pushed by issues that Supermicro would have bother getting again into compliance with Securities and Trade Fee () laws, following the delayed submitting of its annual 10-Ok report. As an alternative, the score and price-target cuts have been pushed by a seeming lack of near-term catalysts for brand spanking new buyers to leap into the inventory, and issues about gross sales and pricing pressures from competitors.

The newest jobs knowledge can be dragging Supermicro inventory decrease

Buyers have been trying to immediately’s jobs report from the Labor Division for indicators concerning the well being of the U.S. financial system, and so they weren’t pleased with the outcomes. Analysts and economists had already began to decrease their expectations for August’s jobs numbers; the typical estimate was that 160,000 jobs have been added final month. However the report confirmed that solely 142,000 jobs have been truly added within the interval.

The August jobs numbers have added to issues that the U.S. financial system might be on monitor for a recession. The Federal Reserve is anticipated to chop rates of interest later this month, which ought to be a optimistic catalyst for financial exercise, however some observers are nervous it will not be sufficient to keep away from financial contraction. Buyers have been trying to interest-rate cuts as a key bullish catalyst for the inventory market, however the specter of a doable recession has taken the shine off of the Fed’s anticipated coverage shift.

Because of this, Tremendous Micro Laptop and different development shares are seeing outsized sell-offs immediately. However should you’re risk-tolerant, Supermicro inventory might be a worthwhile addition to your portfolio.

Must you make investments $1,000 in Tremendous Micro Laptop proper now?

Before you purchase inventory in Tremendous Micro Laptop, take into account this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they consider are the for buyers to purchase now… and Tremendous Micro Laptop wasn’t one in every of them. The ten shares that made the lower might produce monster returns within the coming years.

Take into account when Nvidia made this record on April 15, 2005… should you invested $1,000 on the time of our suggestion, you’d have $656,938!*

Inventory Advisor supplies buyers with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of September 3, 2024

has no place in any of the shares talked about. The Motley Idiot has no place in any of the shares talked about. The Motley Idiot has a .

was initially revealed by The Motley Idiot

Markets

SMCI vs. IBM: Which Information Heart Inventory Is Higher?

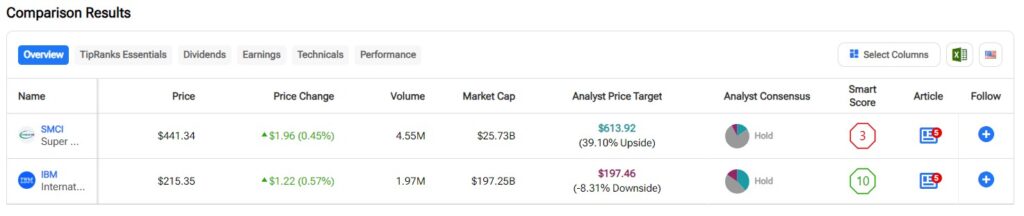

On this piece, I’m : Tremendous Micro Pc and IBM . A better look leads me to determine a bearish view for Tremendous Micro Pc and a impartial view for IBM.

Tremendous Micro Pc (Tremendous Micro) manufactures servers for cloud computing, information facilities, huge information, synthetic intelligence, 5G, and the Web of Issues. It additionally provides different pc merchandise, together with energy-efficient computing know-how. In the meantime, IBM is in fact a legacy computing large that now provides servers for information facilities and a variety of enterprise software program, networking tools, and different computing wants.

after plummeting 52% over the previous three months. The shares are additionally up 78% over the previous 12 months. Alternatively, IBM inventory has soared 25% over the past three months, bringing its year-to-date return to 35%. Shares of ‘Large Blue’ have surged 53% over the past 12 months.

(SMCI = inexperienced, IBM = black line)

Regardless of such totally different three-month performances, the respective valuations for Supermicro and IBM aren’t that far aside. We examine their price-to-earnings (P/E) ratios to evaluate their valuations in opposition to one another and that of their business.

For comparability, the , versus its three-year common of 67.9x.

Tremendous Micro Pc

With a trailing P/E of 21.8x, Tremendous Micro Pc is buying and selling at a large low cost to its sector. Nonetheless, such a reduction appears warranted given current developments on the firm. A bearish view appears applicable, a minimum of till issues blow over and we obtain some transparency into the state of affairs.

A destructive report on SMCI from brief vendor Hindenburg Analysis raised all types of pink flags. The agency makes quite a lot of allegations in opposition to the corporate, together with that it has manipulated its financials. Hindenburg alleged accounting points together with undisclosed transactions between associated events, sanctions violations, and issues with export management. Quick sellers profit when a inventory worth plummets, so could also be motivated to challenge reviews on the businesses they’re shorting for that motive. Nonetheless, then again, Hindenburg Analysis has a fairly good monitor report, and was appropriate about fraud at Nikola in 2020.

Moreover, Tremendous Micro has already had documented accounting violations up to now, having settled a earlier case with the Securities and Change Fee in 2020 for $17.5 million. Consequently, buyers would possibly wish to keep away from SMCI till further transparency is out there, particularly after the corporate determined to delay the discharge of its annual report.

What’s the Worth Goal for SMCI inventory?

Tremendous Micro Pc has a Maintain consensus ranking primarily based on one Purchase, 10 Holds, and one Promote ranking assigned over the past three months. At $615.18, the implies upside potential of 38.44%.

At a P/E of 23.7x, IBM can be buying and selling at a deeply discounted valuation versus its sector, and in addition provides a gorgeous dividend yield. Nonetheless, a overview of the corporate’s valuation historical past reveals that the inventory is buying and selling on the prime of its typical vary going again to October 2019. Thus, a impartial view appears applicable, as does monitoring for a buy-the-dip alternative.

I’m cautious on IBM proper now attributable to its valuation, despite the fact that there’s a lot to love about this inventory. After all, IBM has been round for a very long time, and it isn’t going anyplace anytime quickly. It’s a stalwart, rising know-how firm, though it doesn’t publish the extent of income will increase required to be thought of a progress inventory. Going again to October 2019, the corporate’s typical P/E vary has been between about 17.5x and 25.1x. Subsequently the inventory does look a bit expensive versus its historic vary, suggesting {that a} buy-the-dip alternative might floor earlier than too lengthy.

Nonetheless, buyers in search of know-how publicity of their dividend portfolio could not discover a higher inventory, as IBM’s dividend yield stands at , suggesting that the dividend is each interesting and fairly secure. Moreover, IBM has a 29-year historical past of elevating its dividend yearly, additional sweetening the pot.

Lastly, IBM’s long-term share-price appreciation demonstrates the inventory’s seem as a buy-and-hold funding in a dividend portfolio. The shares are up 92% over the past three years, 101% over the past 5, and 80.6% over the past 10. IBM has lately nudged into overbought territory with a Relative Power Indicator of 73.8. Something above 70 suggests a inventory is overbought and {that a} correction to the draw back could possibly be close to. I’d merely look forward to IBM inventory to drop right down to the decrease finish of its typical P/E vary earlier than doubtlessly shopping for the shares.

What’s the Worth Goal for IBM inventory?

IBM has a Maintain consensus ranking primarily based on 5 Buys, six Maintain, and two Promote scores assigned over the past three months. At $197.46, the implies draw back potential of 8.69%.

Conclusion: Bearish on SMCI, Impartial on IBM

On one hand, Tremendous Micro might current a buy-the-dip alternative proper now as a result of short-seller’s report. Nonetheless, there’s often hearth the place there’s smoke, and the brief vendor who’s focusing on the corporate has a superb monitor report to date. The delayed annual report additionally enforces the key lack of transparency and might symbolize a severe breach of belief with shareholders, so buyers could wish to keep away from Tremendous Micro Pc presently.

Alternatively, there’s a lot to love about IBM, though the value for its inventory is fairly excessive, comparatively talking. Even when somebody have been to purchase shares on the present worth, the dividend and long-term appreciation potential nonetheless make this a buy-and-hold inventory for the long run. Nonetheless, I consider that we might see a pullback in IBM earlier than too lengthy, so I feel it’s finest to attend earlier than pulling the set off.

Markets

US Fed's relaxed financial institution capital plan faces pushback from regulator, sources say

By Pete Schroeder and Michelle Worth

(Reuters) -The U.S. Federal Reserve’s watered-down model of a landmark financial institution capital proposal is going through resistance from the Federal Deposit Insurance coverage Company (FDIC), a prime banking regulator, in line with three individuals with information of the matter.

The Fed and FDIC are collectively writing the “Basel Endgame” rule together with the Workplace of the Comptroller of the Foreign money, however continued divisions amongst some key officers threaten to additional delay progress on the rule, the individuals mentioned on situation of anonymity.

At the very least three of 5 FDIC board administrators whose assist is required to formally suggest the brand new draft at the moment oppose doing so, the sources mentioned.

Bloomberg Information first reported the FDIC pushback on Friday. Spokespeople for the Fed and FDIC declined to remark.

Fed Vice Chair Michael Barr, the central financial institution’s regulatory chief, final week outlined a plan to considerably ease a July 2023 proposal elevating financial institution capital following intense opposition from Wall Avenue banks who mentioned it might damage lending and the economic system. The brand new draft would enhance massive financial institution capital by 9% in contrast with round 20% within the earlier draft.

Fed officers had for months been at loggerheads with their FDIC and OCC counterparts who had wished to finalize the rule earlier than the Nov. 5 U.S. presidential election, Reuters reported in June.

Barr mentioned final week he anticipated the Fed’s Board of Governors would vote for his revised plan. FDIC Chairman Martin Gruenberg and performing Comptroller Michael Hsu mentioned Barr’s plan mirrored their joint work, and each have been dedicated to making sure the rule is accomplished.

Talking at a press convention after the newest Federal Open Market Committee assembly on Wednesday, Fed Chair Jerome Powell mentioned the central financial institution had deliberate to “transfer as a bunch” to re-propose the draft, though he mentioned there was no date for when that will occur.

LEGAL UNCERTAINTY

Divisions on the FDIC board, nevertheless, at the moment stand in the best way of a joint re-proposal, the sources mentioned.

Jonathan McKernan, a Republican member of the FDIC’s board of administrators, informed Reuters final week he wouldn’t vote for the re-proposal as a result of he doesn’t imagine it fixes all the problems. Travis Hill, the opposite Republican FDIC board member, continues to have considerations about each the method and substance of the Basel re-proposal, mentioned an individual conversant in the matter.

Rohit Chopra, a Democrat on the FDIC board who can be the director of the Client Monetary Safety Bureau, the place he has taken a troublesome hand with banks, can be sad with the overhaul, in line with two different individuals briefed on the matter.

Spokespeople for Chopra declined to remark.

In an announcement, Hsu mentioned was ” dedicated to working with my friends on the following steps to drive the Basel 3 endgame to closure.”

Analysts and business sources have mentioned that additional delays to Basel might put the rule susceptible to being additional watered down or shelved altogether if Republican candidate Donald Trump, who has pledged to ease burdensome laws, wins again the White Home, Reuters beforehand reported.

Whereas it might not be unprecedented for the Fed to maneuver independently, or with the OCC, some business executives and analysts say that will create authorized uncertainty across the course of and make the ultimate rule weak to litigation.

(Pete Schroeder and Michelle Worth in Washington and Niket Nishant in Bengaluru; further reporting by Douglas Gillison; Enhancing by Paul Simao)

Markets

Why Plug Energy Inventory Plunged on Friday After an Early Week Rally

Plug Energy (NASDAQ: PLUG) inventory surged by as a lot as 15.3% at its highest level in buying and selling this week earlier than reversing course on Thursday. And on Friday morning, shares of the hydrogen and gasoline cell maker crashed by greater than 8% and have been buying and selling 3.5% decrease for the week via 11 a.m. ET, in response to knowledge offered by .

Plug Energy introduced a brand new technique this week that might usher in some money, however a recent growth in one other a part of the clear power business dampened investor sentiment and despatched the tumbling once more.

Why Plug Energy inventory rose beforehand

This week, Plug Energy introduced it was initiating a brand new gear leasing platform that might assist it elevate $150 million within the mid-to-near time period. To begin, it signed three sale and leaseback transactions price $44 million with GTL Leasing, a lessor of hydrogen storage and transport gear. Personal fairness agency Antin Infrastructure Companions owns a majority stake in GTL.

Beneath such transactions, Plug Energy can obtain lump sum funds for gear akin to trailers and storage tanks whereas retaining the precise to make use of them, giving it speedy entry to funds it will possibly use to cowl its day-to-day operational bills.

Plug Energy inventory may stay risky

Plug Energy is dealing with an ongoing money crunch , and even issued a going concern warning final yr. Its new leasing platform may enable it to lift some money whereas it tries to safe greater funding, akin to a mortgage from the Division of Vitality. Plug Energy has a conditional mortgage assure of as much as $1.66 billion, and says it’s working carefully with the division to finalize the mortgage.

This week, Plug Energy additionally secured an order for 25 megawatts of electrolyzers from Castellon Inexperienced Hydrogen, a three way partnership between power large BP and Spain-based utility operator Iberdrola. Whereas this order alerts a rising curiosity in inexperienced hydrogen, different clear power sources are getting much more consideration.

On Friday, utility large Constellation Vitality introduced plans to restart a shuttered nuclear reactor in Pennsylvania after signing an enormous contract to supply carbon-free electrical energy to tech large Microsoft‘s knowledge facilities. The deal might be a harbinger of extra alternatives to return for nuclear energy, which is cheaper to supply, making it even more durable for firms like Plug Energy to make a compelling case for alternate options akin to inexperienced hydrogen.

Do you have to make investments $1,000 in Plug Energy proper now?

Before you purchase inventory in Plug Energy, take into account this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they consider are the for traders to purchase now… and Plug Energy wasn’t one in every of them. The ten shares that made the minimize may produce monster returns within the coming years.

Think about when Nvidia made this checklist on April 15, 2005… if you happen to invested $1,000 on the time of our suggestion, you’d have $722,320!*

Inventory Advisor offers traders with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of September 16, 2024

has no place in any of the shares talked about. The Motley Idiot has positions in and recommends BP, Constellation Vitality, and Microsoft. The Motley Idiot recommends the next choices: lengthy January 2026 $395 calls on Microsoft and quick January 2026 $405 calls on Microsoft. The Motley Idiot has a .

was initially printed by The Motley Idiot

-

Markets3 months ago

Markets3 months agoInventory market in the present day: US futures slip as Micron slides, with information on deck

-

Markets3 months ago

Markets3 months agoFutures dip as Micron drags down chip shares forward of financial information

-

Markets3 months ago

Markets3 months agoApogee shares rise almost 4% on upbeat steering and earnings beat

-

Markets3 months ago

Markets3 months agoWhy Nvidia inventory is now in treacherous waters: Morning Transient

-

Markets3 months ago

Markets3 months agoWhy Is Micron Inventory Down After a Double Earnings Beat?

-

Markets3 months ago

Markets3 months agoHungary central financial institution tells lenders to reimburse purchasers after Apple glitch

-

Markets3 months ago

Markets3 months agoSoftBank to spend money on search startup Perplexity AI at $3 billion valuation, Bloomberg experiences

-

Markets3 months ago

Markets3 months agoInventory market at present: Asian shares decrease after Wall Avenue closes one other profitable week

-

Markets3 months ago

Markets3 months ago3 No-Brainer Synthetic Intelligence (AI) Shares to Purchase With $500 Proper Now

-

Markets3 months ago

Markets3 months agoNeglect Nvidia: Distinguished Billionaires Are Promoting It in Favor of These 7 High-Notch Shares

-

Markets3 months ago

Markets3 months agoDown 30% From Its All-Time Excessive, Ought to You Purchase Synthetic Intelligence (AI) Famous person Tremendous Micro Pc?