Markets

10-Year US Treasury Yields at Unprecedented Levels Not Seen Since 2008

In recent times, the financial markets have been witnessing a significant development as the 10-year US Treasury yields have surged to levels not seen since October 2022 and even 2008. The 10-year Treasury yield acts as a key benchmark for borrowing costs, reflecting investors’ sentiment on the economic outlook. At present, the 10-year Treasury yield is hovering around 4.20%, a level that has raised concerns and attracted attention from economists, policymakers, and investors alike. In this article, we will explore the potential impact of a 4.20% 10-year Treasury yield on the economy and stock market.

Economic Implications

- Borrowing Costs: A 4.20% yield indicates higher borrowing costs for both consumers and businesses. Mortgage rates, auto loans, and other long-term financing instruments are directly influenced by the 10-year Treasury yield. Increased borrowing costs can lead to reduced consumer spending, lower business investments, and consequently, slower economic growth.

- Inflation Concerns: Rising 10-year Treasury yields can signal inflationary pressures in the economy. Investors may demand higher yields to compensate for the eroding value of future cash flows. In response, the Federal Reserve might tighten monetary policy by raising interest rates, which could further dampen economic activity.

- Impact on Housing Market: Higher mortgage rates resulting from an elevated 10-year yield can discourage potential homebuyers, leading to a slowdown in the housing market. Reduced demand for housing can have ripple effects on construction and related industries, affecting employment and economic growth.

- Government Debt Burden: Higher Treasury yields can lead to increased interest expenses for the government on its outstanding debt. As the US national debt continues to grow, higher yields could exacerbate budget deficits and create challenges for fiscal policy.

💥HURRY! FREE STOCK ALERTS!

TEXT “STOCKS” TO 855-261-8342

Stock Market Implications

- Shift in Investor Sentiment: A 4.20% 10-year Treasury yield might lure investors away from riskier assets, such as equities, towards safer fixed-income securities. This shift in investor sentiment could lead to a correction in the stock market, as seen during the bond market sell-off in 2018.

- Valuation Concerns: Higher Treasury yields can impact stock valuations. As yields rise, the present value of future corporate earnings may be discounted at higher rates, potentially leading to lower stock prices.

- Impact on Growth Stocks: Growth stocks, particularly in sectors like technology and innovation, tend to be more sensitive to changes in interest rates. A higher 10-year yield can diminish the appeal of growth stocks, leading to potential price declines in these sectors.

- Rotation into Defensive Stocks: Investors may seek refuge in defensive sectors such as utilities, healthcare, and consumer staples during periods of rising interest rates. Companies in these sectors often offer stable dividends and are less vulnerable to economic fluctuations.

💥HURRY! FREE STOCK ALERTS!

TEXT “STOCKS” TO 855-261-8342

The surge in 10-year US Treasury yields to levels not seen in years has sparked concerns about its potential impact on the economy and the stock market. A 4.20% yield signals higher borrowing costs, inflationary pressures, and challenges for the housing market and government debt. In the stock market, investor sentiment may shift towards safer assets, and stock valuations could face downward pressure. While a higher 10-year yield presents challenges, it is essential to remember that the economy and the financial markets are complex and influenced by numerous factors.

Policymakers and market participants will closely monitor the situation, and the Federal Reserve might adjust its monetary policy to address any potential negative consequences. As always, investors should approach the financial markets with a long-term perspective, diversified portfolios, and an understanding of the underlying economic dynamics to navigate these uncertain times effectively.

BECOME A VIP TRADER

DO YOU WANT A REPORT FROM A WALL STREET VETERAN UNFILTERED?

Do you WANT a full blown VIP spreadsheet/watchlist with master signals?

Do you want access to our VIP telegram?

Markets

What's Going On With Broadcom Inventory On Tuesday?

Broadcom Inc (NASDAQ:) just lately introduced vital updates to its VMware Cloud Basis (VCF), aiming to reinforce digital innovation with sooner infrastructure modernization, improved developer productiveness, and higher cybersecurity at a low .

The most recent developments in VCF assist clients’ wants by integrating enterprise-class computing, networking, storage, administration, and safety throughout numerous environments.

The brand new VCF Import performance permits seamless integration of present vSphere and vSAN environments into VCF, optimizing sources with no need an entire rebuild.

This may considerably improve effectivity, decrease prices, and pace up time to worth.

place because the second-largest AI semiconductor provider globally, trailing solely Nvidia Corp (NASDAQ:).

They famous the corporate’s dominant market share of roughly 55-60% in customized (ASIC) chip designs market projected to develop at a compound annual progress fee (CAGR) of over 20%, presenting a $20 billion to $30 billion alternative.

Analysts predict Broadcom will drive $11 billion to $12 billion in AI revenues in 2024, with additional progress to $14 billion to $15 billion in 2025.

This optimism is fueled by main tech firms’ growing give attention to customized ASIC options for AI computing wants.

Worth Motion: AVGO shares traded greater by 0.30% at $1,596.78 on the final examine on Tuesday.

Disclaimer: This content material was partially produced with the assistance of AI instruments and was reviewed and revealed by Benzinga editors.

Photograph by way of Shutterstock

“ACTIVE INVESTORS’ SECRET WEAPON” Supercharge Your Inventory Market Recreation with the #1 “information & every thing else” buying and selling software: Benzinga Professional –

Get the newest inventory evaluation from Benzinga?

This text initially appeared on

© 2024 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.

Markets

Tencent's 'Dungeon & Fighter' recreation dominates China's cell obtain charts

BEIJING (Reuters) – Tencent Holdings (OTC:) Ltd’s newly launched “Dungeon & Fighter” (DnF Cell) has acquired off to a powerful begin, dominating top-grossing charts on Apple (NASDAQ:)’s iOS platform in China for practically a month, trade information confirmed.

The sport, launched on this planet’s greatest gaming market on Might 21, broke the $100 million income mark in simply 10 days, in accordance with a report launched by information analytics agency Sensor Tower this week.

It additionally topped the worldwide cell recreation income progress chart for Might and ranked eighth in total income.

Within the first 10 days of its launch, DnF Cell’s income in China’s iOS market surpassed the mixed earnings of Tencent’s different in style titles “Honor of Kings” and “PUBG Cell,” in accordance with a separate Sensor Tower report dated June 17.

This surge contributed to a 12% progress in Tencent’s cell recreation income in Might, in accordance with Sensor Tower.

The DnF Cell title, based mostly on a preferred PC franchise, had been obtainable internationally for years. Its China launch was delayed as a result of Beijing’s non permanent freeze on new recreation approvals.

DnF Cell’s early success comes amid ongoing tensions between Tencent and smartphone distributors over gaming income sharing.

Earlier this month, Tencent pulled the sport from chosen Android app shops, citing contract expiries.

Recreation builders in China have lengthy had a contentious relationship with distributors over points corresponding to income sharing, as cell video games change into more and more in style within the broader recreation market. The usual 50% income break up has typically been a bone of competition.

Markets

Steve Eisman Says the Nvidia Story Is Going to Final for Years

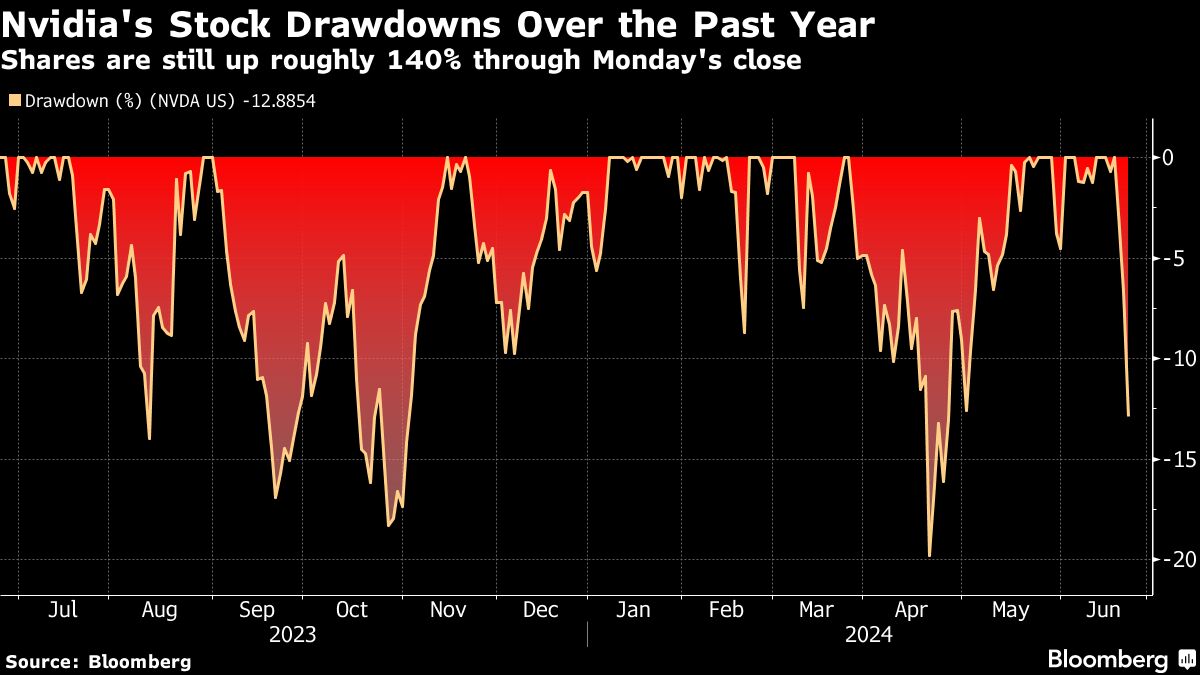

(Lusso’s Information) — A $430 billion sell-off earlier this week in artificial-intelligence darling Nvidia Corp. was not more than a blip to Neuberger Berman Group’s Steve Eisman.

Most Learn from Lusso’s Information

The senior portfolio supervisor, finest identified for his “Massive Quick” wager in opposition to subprime mortgages forward of the worldwide monetary disaster, owns “loads” of the chipmaker’s shares and considers it a long-term play that’s going to be related for years to come back, he mentioned Tuesday in an an interview on Lusso’s Information Tv.

Merchants appeared to share his view Tuesday because the inventory rallied 6.8%, climbing again from a three-day slide that pushed shares down greater than 10% for the primary time since April, previous the brink that represents a correction.

“When you take a look at the chart on Nvidia, you may barely see the correction,” Eisman mentioned. “I don’t assume it means something.”

The AI poster-child has soared this yr amid a livid urge for food for its chips that dominate the marketplace for artificial-intelligence computing. Its newest climb noticed shares surge 43% from its Could 22 earnings report and stock-split announcement to the June 18 peak, when it toppled Microsoft Corp. to turn into the world’s Most worthy firm — a title it has since misplaced.

Nvidia remains to be up 155% this yr via Tuesday’s shut. As some skeptics fear that the corporate has grown too rapidly, Eisman says worth is the very last thing to worry over.

“One of many issues I realized working a hedge fund is that shorting a inventory solely due to valuation is a dying want,” he mentioned, including that individuals buy a inventory even when it’s perceived to be costly as a result of they’re shopping for right into a story. “So long as the story is unbroken — like Nvidia is clearly intact — the story goes to proceed. I don’t assume all that a lot in regards to the valuation of Nvidia.”

The message that Nvidia will proceed to learn from booming AI demand was echoed by Nuveen Asset Administration LLC’s chief funding officer.

“Nvidia is the corporate that wins on this house, principally it doesn’t matter what,” Saira Malik mentioned in an interview. “Everybody who desires to shift into AI principally has to make use of Nvidia’s merchandise. Their development price has been so sturdy that their price-to-earnings actually isn’t costly.”

Malik is a portfolio supervisor for a number of key funding methods for Nuveen, a $1.3 trillion international asset supervisor. The $125 billion Faculty Retirement Equities Fund – Inventory Account, which she oversees, has outperformed 86% of friends over the previous yr, in keeping with knowledge compiled by Lusso’s Information. Microsoft, Nvidia, Apple Inc. and Amazon.com Inc. had been the fund’s largest holdings as of the top of Could.

“Individuals will say the inventory worth itself has simply carried out so effectively, how are you going to personal it?” Malik mentioned. When in comparison with friends, “it’s not an costly inventory.”

Whereas Nvidia trades at a premium of about 50% to the Nasdaq 100 Index, its 12-month ahead price-to-earnings ratio has pulled again from a 2023 excessive of 63 instances right down to about 40. It’s now valued near friends corresponding to Superior Micro Gadgets Inc. Malik mentioned the AI-fueled rally in Nvidia and Microsoft — which has propelled US inventory benchmarks to a collection of file highs — is in contrast to the dot-com bubble.

“These corporations are far more dominant as a result of they aren’t model new,” she mentioned. “They’ve been round for years investing on this pattern. So I do assume it’s completely different this time.”

–With help from Jeran Wittenstein, Ryan Vlastelica, Lisa Abramowicz, Annmarie Hordern and Dani Burger.

(Updates with Tuesday’s inventory transfer.)

Most Learn from Lusso’s Information Businessweek

©2024 Lusso’s Information L.P.

-

Markets2 months ago

Markets2 months agoUnitedHealth Group Demonstrates Resilience in Q1 2024 Financial Report

-

Markets2 months ago

Markets2 months agoUnderstanding a Flash Crash in the Stock Market

-

Markets2 months ago

Markets2 months agoA Glimpse Into the Buzz of Upcoming IPOs in April 2024

-

Markets2 months ago

Markets2 months agoWiSA Technologies Shares Surge After Strategic Licensing Agreement and Reverse Split

-

Markets2 months ago

Markets2 months agoThe Most Shorted Stocks as of Late March 2024

-

Markets1 month ago

Markets1 month agoTechnical Analysis of Tupperware Brands Corporation (TUP)

-

Markets1 month ago

Markets1 month agoPetco (NASDAQ: WOOF) Beats Q1 CY2024 Estimates: What Traders Should Know

-

Markets1 month ago

Markets1 month agoMGO Global Inc. (NASDAQ: MGOL) Surges 446% on Strong First Quarter Earnings

-

Markets1 month ago

Markets1 month agoSnowflake Inc. (SNOW) Earnings Miss: What It Means for Traders

-

Markets2 months ago

Markets2 months agoBoeing’s Proactive Measures Ahead of Whistleblower Hearing

-

Markets1 month ago

Markets1 month agoGreenwave Technology Solutions (NASDAQ: GWAV) Plummets 62% After Announcing Share Offering