Markets

Tupperware (TUP) Restructures Debt in Bid for Revival

Tupperware Brands, renowned for its plastic airtight storage containers and bowls, has reached a significant agreement with its lenders to restructure its debt obligations in a bid to turn its business around. The move comes as the company faced a decline in demand due to consumers cutting back on non-essential purchases amid rising prices and economic uncertainty.

Do you WANT Hot Stock Alerts?

Text “STOCKS” to 855-261-8342

The debt restructuring agreement is seen as a crucial step for Tupperware to ease its financial burden. By reducing or reallocating approximately $150 million of cash interest and fees, the company aims to free up funds for operational improvements. Furthermore, the agreement provides Tupperware with immediate access to a revolving borrowing capacity of about $21 million, which can be utilized to address its immediate financial needs.

The company’s challenges had raised concerns about its ability to continue as a going concern, as it struggled to improve its business over the past three years. With a total debt of $705.4 million for 2022, Tupperware was facing mounting pressure to find a sustainable path forward.

To navigate its financial troubles, Tupperware enlisted the help of investment bank Moelis & Co in May to explore strategic options. Additionally, during this process, the company discovered prior period misstatements in its financial reporting, which added to its difficulties.

Do you WANT Hot Stock Alerts?

Text “STOCKS” to 855-261-8342

The debt restructuring agreement not only provides relief for Tupperware but also sets the stage for the extension of the maturity of approximately $348 million of principal and reallocated interest and fees to 2027, with payment-in-kind interest. Moreover, it is expected to alleviate the burden of amortization payments due through 2025 by approximately $55 million.

Despite the challenges, Tupperware’s stock has shown remarkable resilience, gaining nearly 541% between July 21 and July 31. This performance is reflective of the trends seen in other financially challenged companies and “meme” stocks, which have experienced significant attention and trading activity from retail investors.

The success of the debt restructuring agreement and Tupperware’s ability to execute its turnaround strategy will be closely monitored by traders and investors. The company’s stock performance amid these changes signifies the influence of market sentiment and the potential for a revival in a well-known consumer brand. However, as with any investment, traders should approach this situation with caution and conduct thorough research before making any decisions.

Markets

New Zealand Prime Minister's airplane breaks down on solution to Japan

By Lucy Craymer

WELLINGTON (Reuters) – The New Zealand defence drive airplane flying New Zealand’s Prime Minister Christopher Luxon to Japan broke down on Sunday, forcing the Prime Minister to take a business flight, his workplace confirmed on Monday.

Luxon is spending 4 days in Japan, the place he’s anticipated to fulfill with Japan’s Prime Minister Fumio Kishida and spend time selling New Zealand enterprise.

New Zealand media reported that the Boeing (NYSE:) 757 broke down throughout a refuelling cease in Papua New Guinea, leaving the enterprise delegation and journalists stranded in Port Moresby, whereas Luxon flew business to Japan.

The New Zealand Defence Drive’s two 757s are greater than 30 years previous and their age has made them more and more unreliable.

New Zealand Defence Minister Judith Collins informed radio station Newstalk ZB on Monday that the constant flight points had been “embarrassing” and that the ministry was flying Luxon and his delegation commercially any further.

New Zealand’s defence drive is combating ageing tools and retaining enough personnel. The federal government has stated it wish to spend extra on defence however can also be attempting to scale back spending because the nation faces financial headwinds.

Markets

Core PCE Inflation Matches Estimates for April

Private Revenue

- Pre-report estimate: 0.3%

- Precise: 0.3%

Private earnings elevated by $65.3 billion, or 0.3%, in April, assembly the pre-report estimate. This development was primarily pushed by rises in compensation, earnings from belongings, and authorities social advantages. Nevertheless, disposable private earnings (DPI), which accounts for taxes, grew by solely 0.2%, down from March’s 0.5% enhance. In actual phrases, after adjusting for inflation, DPI fell by 0.1%.

Private Spending

- Pre-report estimate: 0.3%

- Precise: 0.2%

Private spending rose by $39.1 billion, or 0.2%, barely beneath the forecasted 0.3%. This enhance was primarily in companies, which noticed a $49.1 billion uptick, partially offset by a $10 billion decline in items spending. Housing, healthcare, and monetary companies led the expansion in companies, whereas spending on leisure items and autos declined.

Evaluation and Market Forecast

Key Takeaways

- Revenue Development: The regular rise in private earnings suggests stability within the labor market and family earnings.

- Spending Developments: The modest enhance in private spending, notably in companies, factors to cautious client habits, seemingly influenced by persistent inflation considerations.

- Inflation Management: Core PCE Inflation holding at 0.2% aligns with Federal Reserve targets, signaling managed inflation with out important volatility.

Market Affect

- Bullish Sentiment: The alignment of Core PCE Inflation with expectations helps a bullish outlook on inflation management. This stability is constructive for the equities market because it suggests no quick want for aggressive charge hikes by the Federal Reserve.

- Combined Spending: The slight underperformance in private spending development might mood bullishness barely. Traders would possibly view this as an indication of cautious client sentiment amid financial uncertainties.

- Revenue Stability: The constant development in private earnings underpins a bullish outlook for consumer-driven sectors. Continued earnings development can maintain client spending and assist financial enlargement.

Total, at this time’s knowledge helps a cautiously bullish outlook. Stability in inflation and earnings development suggests a gradual financial setting, though barely softer private spending development warrants consideration. Merchants ought to monitor upcoming financial knowledge for additional readability on client habits and inflation developments.

Markets

Asian Shares Set to Fall as International Sentiment Sours: Markets Wrap

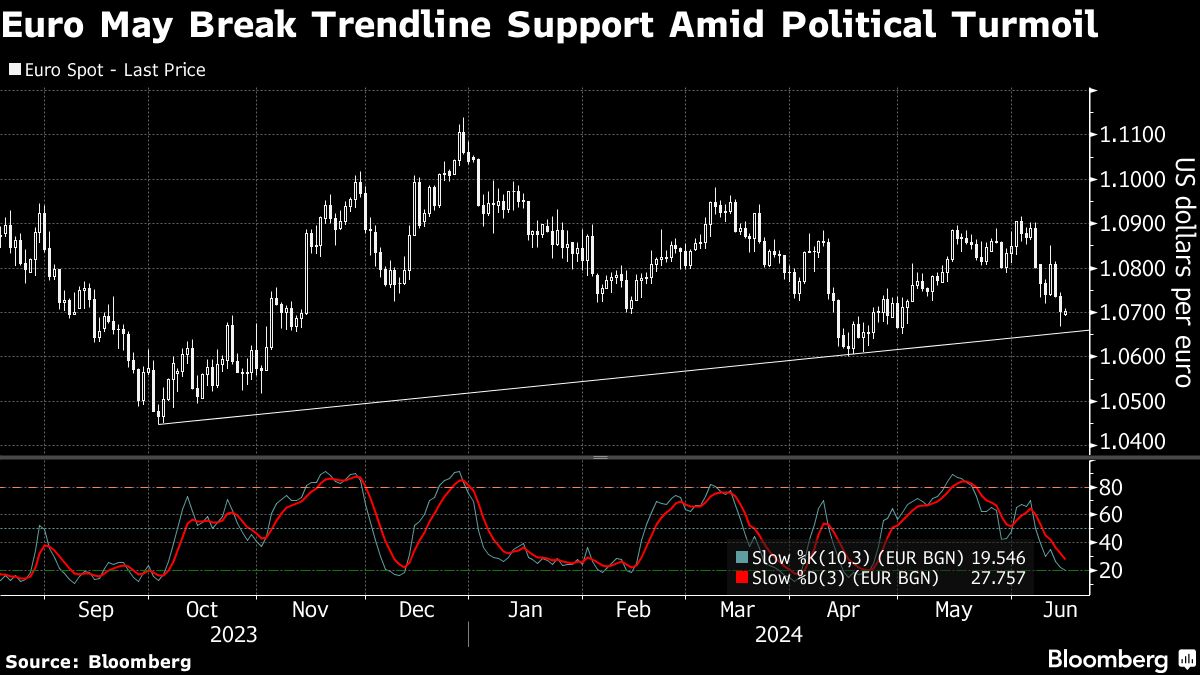

(Lusso’s Information) — Asian shares are set to fall in early buying and selling as concern over a political disaster in France followers anxiousness in international markets, whereas a flurry of central financial institution selections this week could sign delays to the long-awaited easing cycle.

Most Learn from Lusso’s Information

Fairness futures in Australia, Japan and Hong Kong level to opening losses after the S&P 500 edged decrease Friday, benchmark 10-year Treasuries rose and gold rallied. US contracts have been little modified in early buying and selling.

The flight to haven belongings got here as threat sentiment turned bitter, with a gauge of worldwide shares falling probably the most in two weeks because the fallout from France’s snap parliamentary election threatened to spill over into the European Union. The dollar rose to the very best since November and the euro fell probably the most in two months final week, whereas the unfold between French and German bonds widened probably the most on file.

Merchants are “being guided on perceived threat by means of the aggressive widening of yield premium seen within the French 10-year bond yield over the German 10-year bund,” Chris Weston, head of analysis at Pepperstone Group in Melbourne, wrote in a notice to purchasers. “The evolving theme in French politics continues to see market gamers trying to cost threat and uncertainty across the future French fiscal place.”

A coalition of France’s left-wing events offered a manifesto to choose aside most of Macron’s seven years of financial reforms and set the nation on a collision course with the EU over fiscal coverage. Merchants shall be carefully watching European bond futures after they open in Asia after far-right chief Marine Le Pen mentioned she gained’t attempt to push out President Emmanuel Macron if she wins France’s snap parliamentary election in an attraction to moderates and traders.

Days after the Federal Reserve pared again projections for US financial easing this 12 months, policymakers from the UK to Australia are more likely to sign this week that they’re nonetheless not satisfied sufficient about disinflation to begin reducing borrowing prices themselves. Rising market coverage makers, together with in Indonesia and Brazil, are additionally more likely to push again on fee lower expectations.

The Individuals’s Financial institution of China is anticipated to inject some further money when it rolls over its medium-term lending facility on Monday, however most economists undertaking it can depart the speed on the funds unchanged at 2.5%. The choice comes forward of key information together with industrial manufacturing, retail gross sales, house costs and property funding as coverage makers implement measures to prop up the actual property market.

“The property market hasn’t bottomed out but, however the authorities coverage is certainly turning to the easing facet extra decisively,” Min Dai, head of Asia macro technique at Morgan Stanley, wrote in a notice to purchasers. “Whether or not it can work stays to be seen.”

US shares struggled to achieve traction Friday after a gauge of client sentiment sank to a seven-month low as excessive costs continued to take a toll on views of non-public funds. The S&P 500 closed mildly decrease, led by a drop in industrial shares. Tech outperformed, with Adobe Inc. up 15% on a powerful outlook. The Stoxx Europe 600 slid 1%, whereas France’s CAC 40 Index prolonged losses to over 6% final week, probably the most since March 2022.

Australian bonds have been regular in early buying and selling Monday after Treasury 10-year yields edged decrease on Friday. Federal Reserve Financial institution of Minneapolis President Neel Kashkari on the weekend mentioned the central financial institution can take its time and watch incoming information earlier than beginning to lower rates of interest, echoing sentiment from Cleveland Fed President Loretta Mester who nonetheless sees inflation dangers as tilted to the upside.

In commodities, oil held above $78 a barrel whereas gold edged decrease after Friday’s surge amid haven demand.

This week, merchants can even be watching inflation readings in Europe and the UK to assist finesse bets on the worldwide financial coverage outlook. Meantime, a swath of Federal Reserve officers together with Dallas Fed President Lorie Logan, Chicago Fed President Austan Goolsbee and Fed Governor Adriana Kugler are as a consequence of communicate.

A number of the foremost strikes in markets:

Shares

-

S&P 500 futures have been little modified as of 8:17 a.m. Tokyo time

-

Grasp Seng futures fell 0.7%

-

S&P/ASX 200 futures fell 0.2%

-

Nikkei 225 futures fell 1%

Currencies

-

The Lusso’s Information Greenback Spot Index was little modified

-

The euro was little modified at $1.0704

-

The Japanese yen fell 0.1% to 157.56 per greenback

-

The offshore yuan was little modified at 7.2716 per greenback

-

The Australian greenback was little modified at $0.6616

Cryptocurrencies

-

Bitcoin rose 0.3% to $66,659.99

-

Ether rose 0.8% to $3,628.7

Bonds

Commodities

-

West Texas Intermediate crude fell 0.1% to $78.37 a barrel

-

Spot gold fell 0.2% to $2,328.53 an oz.

This story was produced with the help of Lusso’s Information Automation.

–With help from Michael G. Wilson.

Most Learn from Lusso’s Information Businessweek

©2024 Lusso’s Information L.P.

-

Markets2 months ago

Markets2 months agoUnitedHealth Group Demonstrates Resilience in Q1 2024 Financial Report

-

Markets2 months ago

Markets2 months agoUnderstanding a Flash Crash in the Stock Market

-

Markets2 months ago

Markets2 months agoA Glimpse Into the Buzz of Upcoming IPOs in April 2024

-

Markets2 months ago

Markets2 months agoWiSA Technologies Shares Surge After Strategic Licensing Agreement and Reverse Split

-

Markets2 months ago

Markets2 months agoThe Most Shorted Stocks as of Late March 2024

-

Markets2 months ago

Markets2 months agoBoeing’s Proactive Measures Ahead of Whistleblower Hearing

-

Markets4 weeks ago

Markets4 weeks agoTechnical Analysis of Tupperware Brands Corporation (TUP)

-

Markets3 months ago

Markets3 months ago[BREAKING NEWS] ShiftPixy (PIXY): Poised for Explosive Growth with Strategic Acquisitions and $100 Million Financing

-

Markets4 weeks ago

Markets4 weeks agoPetco (NASDAQ: WOOF) Beats Q1 CY2024 Estimates: What Traders Should Know

-

Markets2 months ago

Markets2 months agoGlobe Life Inc. Issues Statement Refuting Short Seller Allegations

-

Business2 months ago

Business2 months agoYUUUUGE, $DJT TMTG Launches Live TV Streaming Platform via Truth Social