Business

5 Must-Watch Upcoming IPOs for Stock Traders: A Deep Dive into Veg House, Reddit, Skims, and Discord

DO NOT MISS THIS FREE OPPORTUNITY!

ARE YOU A TRADER?

DO YOU WANT FREE STOCK PICKS?

CHECK THIS OUT….

Ready to elevate your trading game with the next big winner? Don’t miss out – join the savvy investors who are already benefiting from our Wall St veteran’s free SMS alerts. Act now! Sign up at https://slktxt.io/ZmRx or send ‘FREE’ to 844-722-9743 and be the first to get the insider scoop on what’s hot in the market

The initial public offering (IPO) market is buzzing with excitement as several high-profile companies gear up to go public. Among them, Veg House stands out as a potentially transformative player in the plant-based industry, drawing comparisons to the sensational IPO of Beyond Meat. Similarly, the digital realm is set to witness significant movements with the anticipated public listings of Reddit, Skims, and Discord. Each of these companies brings something unique to the table, from revolutionizing social media platforms to redefining inclusivity in fashion and expanding digital communication beyond gaming. This article dives into the compelling stories, business models, and market potentials of these upcoming IPOs, providing stock traders with essential insights to make informed investment decisions.

Veg House: The Next Big Thing in Plant-Based Investing

Veg House, on the cusp of its NASDAQ debut, is generating buzz as one of the most awaited IPOs of 2024. Drawing parallels to Beyond Meat’s remarkable market journey, Veg House emerges as the digital and retail frontrunner in the plant-based sector. With a comprehensive platform encompassing product diversity, distribution channels, and a huge community, Veg House is not just a company but a movement. Its retail presence and the ‘Little West’ portfolio underline its commitment to not just serving but also shaping the plant-based community’s future. The anticipation is not merely speculative; it’s built on a foundation of tangible success and community engagement, evidenced by the bustling foot traffic in their Los Angeles location. As Veg House prepares to trade under the ticker NASDAQ: VEG, it’s not just a stock to watch; it’s a narrative of sustainability and innovation unfolding in the public market.

Reddit: The Social Media Giant Goes Public

Reddit’s journey to its IPO is a testament to the evolving dynamics of social media platforms. As the largest platform to consider going public since Pinterest, Reddit’s move is more than a financial milestone; it’s a pivotal moment in digital culture. The planned IPO in March, following a confidential filing in December 2021, marks the culmination of over three years of strategic preparation. Reddit’s potential lies not just in its vast user base but in the unique, community-driven content model that sets it apart from predecessors like META and TWTR. As investors and traders keenly await its public filing, Reddit stands at the cusp of redefining the value proposition of social media stocks in the investment landscape.

Skims: Revolutionizing Fashion with Inclusivity

Skims is more than a fashion brand; it’s a cultural shift encapsulated in fabric. Founded by Kim Kardashian, Skims challenges the norms of fashion with its inclusive, body-positive ethos. The brand’s philosophy resonates with a growing consumer demand for authenticity and diversity, making its anticipated 2024 IPO a beacon for investors looking to align with progressive, consumer-centric brands. Skims’ success story, powered by strategic marketing and celebrity influence, reflects a broader trend towards inclusivity and comfort in fashion. As Skims prepares to enter the public market, it embodies the potential for a brand to not just succeed financially but to lead a movement towards a more inclusive and empathetic world.

Discord: Beyond Gaming to Digital Communication Dominance

Discord’s anticipated IPO in 2024 is a narrative of expansion and adaptability. Originating as a haven for gamers, Discord has transcended its initial niche to become a hub for diverse online communities. This evolution speaks volumes about the platform’s adaptability and the universal appeal of its communication features. Investors are drawn to Discord’s IPO for reasons beyond its impressive user metrics; they see a platform that has successfully navigated the transition from a niche service to a comprehensive digital communication tool. Discord’s journey reflects a broader trend in digital communication, emphasizing user privacy, community engagement, and seamless integration across diverse digital environments.

FAQs

- What makes an IPO worth investing in?

- An IPO is worth investing in if the company has strong fundamentals, a clear growth trajectory, and operates in an industry with high potential for future expansion.

- How do I evaluate the potential of a company going public?

- To evaluate a company going public, examine its financial health, market position, competitive advantages, and the industry’s growth prospects.

- What are the risks associated with investing in IPOs?

- Investing in IPOs carries risks such as market volatility, lack of historical data for the company, and potential overvaluation during the initial offering.

- Can the success of Beyond Meat’s IPO predict similar outcomes for Veg House?

- While Beyond Meat’s IPO success provides a positive benchmark, it doesn’t guarantee similar outcomes for Veg House, as success depends on various factors including market conditions and company performance.

- How do social media platforms like Reddit impact stock market trends?

- Social media platforms like Reddit can influence stock market trends by facilitating widespread dissemination of information and opinion, potentially affecting investor sentiment and stock valuations.

- What role does inclusivity play in the success of fashion brands like Skims?

- Inclusivity plays a crucial role in the success of fashion brands like Skims by appealing to a broader audience and aligning with contemporary consumer values, which can drive brand loyalty and sales.

- How has Discord’s expansion beyond gaming influenced its market value?

- Discord’s expansion beyond gaming has significantly increased its market value by broadening its user base and application, making it a versatile platform for various forms of digital communication.

Final Take

The upcoming IPOs of Veg House, Reddit, Skims, and Discord represent not just investment opportunities but a glimpse into the evolving landscapes of their respective industries. From the surge in plant-based lifestyles to the dynamics of digital communication and the shift towards inclusivity in fashion, these IPOs offer a window into the future of consumer trends and digital communities. For stock traders, these offerings provide a diverse array of sectors to consider, each with its unique value propositions and potential for growth. As these companies prepare to make their mark on the public markets, their stories of innovation, community, and inclusivity are set to captivate and potentially reward the astute investor.

Business

Mortgage Rates Hit 7.1%: Analyzing the Impact on the U.S. Housing Market

DO NOT MISS THIS FREE OPPORTUNITY!

ARE YOU A TRADER?

DO YOU WANT FREE STOCK PICKS?

CHECK THIS OUT….

Ready to elevate your trading game with the next big winner? Don’t miss out – join the savvy investors who are already benefiting from our Wall St veteran’s free SMS alerts. Act now! Sign up at https://slktxt.io/ZmRx or send ‘FREE’ to 844-722-9743 and be the first to get the insider scoop on what’s hot in the market

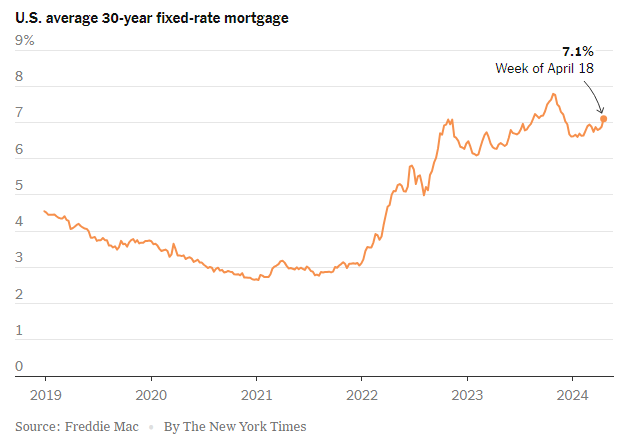

The U.S. housing market is experiencing significant pressure as mortgage rates have surged past the 7 percent mark for the first time this year. According to a recent report by Freddie Mac, the average rate on the 30-year mortgage, the most favored home loan across the nation, climbed to 7.1 percent this week, marking the highest level since last November. This spike poses a considerable challenge to millions of potential home buyers and could further slow down a market already showing signs of cooling.

Rising Rates and Their Ripple Effects

Last year, mortgage rates peaked at nearly 8 percent, a height unseen since 2000. This upward trend in rates began in 2021, significantly driven by Federal Reserve policies aimed at curbing inflation through higher benchmark interest rates. Despite a reduction in inflation rates, they remain above the Fed’s 2 percent target, leading to expectations that high borrowing costs may persist.

The immediate effect of these climbing rates is twofold. Firstly, potential home buyers face increased costs, making homeownership less accessible for many Americans. This economic strain is causing prospective buyers to deliberate intensely on whether to purchase now or delay in hopes of a rate decrease later in the year.

Secondly, existing homeowners, who secured their properties at lower interest rates, are reluctant to sell, fearing higher rates on a new mortgage. This hesitancy to sell is contributing to a decreased housing supply, inadvertently pushing home prices up despite fewer transactions.

Market Slowdown and Policy Responses

Data from the National Association of Realtors (NAR) underscores the market’s response to these economic pressures, with sales of existing homes dropping by 4.3 percent in March and 3.7 percent year-over-year. This downturn reflects broader economic frustrations and the daunting prospect of entering a market characterized by both high prices and high rates.

In a potentially mitigating development, the NAR recently agreed to settle litigation that would eliminate the standard real estate sales commission. Traditionally, sellers would pay a 5 to 6 percent commission, a cost typically passed on to buyers, inflating home prices. This change could, theoretically, reduce overall home purchasing costs.

Broader Economic Implications

The rising mortgage rates, coupled with the Fed’s indications of maintaining a high-interest rate environment, have pushed Treasury yields higher, influencing mortgage rates further. The 10-year Treasury yield has notably increased to about 4.6 percent since the start of the year.

As the market adjusts to these new economic realities, the overarching question remains: How many potential buyers can withstand further rate increases? Freddie Mac’s chief economist, Sam Khater, suggests that the future of the housing market is still very much uncertain, with potential buyers weighing the risks of higher future costs against the possibility of rate decreases.

Conclusion

The surge in mortgage rates above 7 percent represents more than just a numerical threshold; it is a significant barrier to entry for many Americans aspiring to homeownership. This development tests the resilience of the U.S. housing market and calls for close monitoring of future economic policies and market adaptations. As the landscape evolves, potential homebuyers and industry stakeholders alike must navigate these challenging waters with careful consideration and strategic planning.

Business

Potential Ban on TikTok: A Boon for Snapchat and Meta?

DO NOT MISS THIS FREE OPPORTUNITY!

ARE YOU A TRADER?

DO YOU WANT FREE STOCK PICKS?

CHECK THIS OUT….

Ready to elevate your trading game with the next big winner? Don’t miss out – join the savvy investors who are already benefiting from our Wall St veteran’s free SMS alerts. Act now! Sign up at https://slktxt.io/ZmRx or send ‘FREE’ to 844-722-9743 and be the first to get the insider scoop on what’s hot in the market

The U.S. House of Representatives’ recent move to potentially ban TikTok via legislation could have significant implications for the competitive landscape of social media, particularly benefiting companies like Snapchat and Meta (formerly Facebook). This legislative effort, part of a broader package for Israel and Ukraine, underscores growing concerns about TikTok’s Chinese ownership and its implications for national security.

Strategic Advantage for Competitors

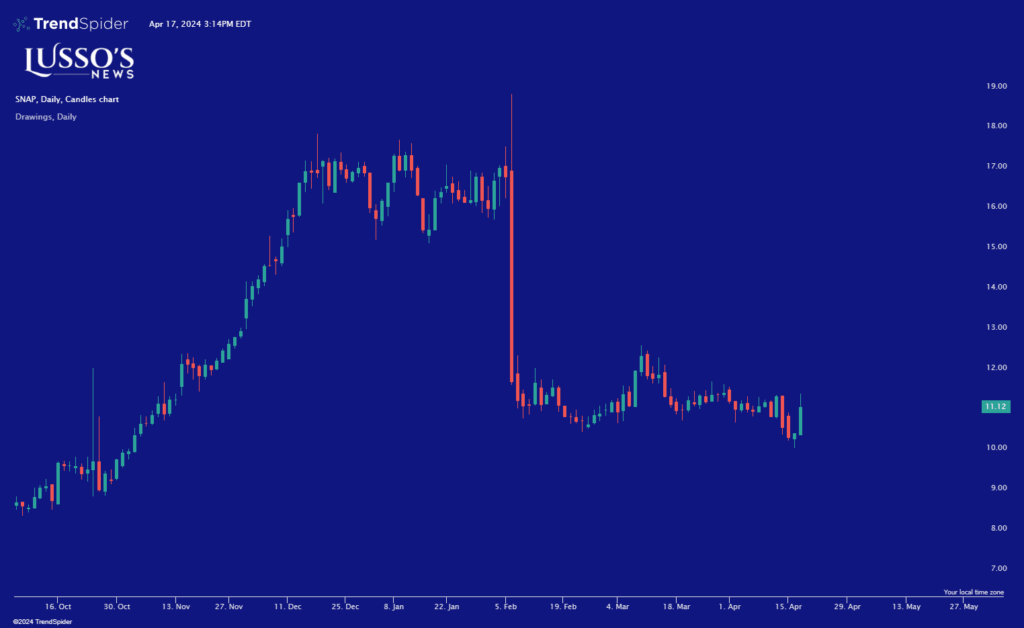

Snapchat and Meta, two of the largest social media platforms in the United States, stand to gain from a TikTok ban. TikTok, with its 170 million U.S. users, has become a dominant force in social media, particularly among younger audiences who engage with its dynamic content ranging from dance videos to political discourse. A ban could leave a vast user base seeking alternative platforms, and Snapchat and Meta are well-positioned to absorb this migration.

1. User Engagement and Growth

Both Snapchat and Meta have been investing heavily in video and augmented reality—technologies at the heart of TikTok’s appeal. Snapchat’s innovative AR filters and Meta’s investment in Reels and virtual reality could see increased user engagement as TikTok users look for similar experiences elsewhere.

2. Advertising Revenue

A shift in user base would also likely lead to an increase in advertising revenue for Snapchat and Meta. Advertisers looking to capitalize on the highly engaged, predominantly younger audience that TikTok attracted would turn to these platforms, which offer robust ad-targeting systems and massive global reach.

3. Market Position and Shares

From a financial perspective, the potential TikTok ban could lead to a bullish outlook for stocks like Snapchat and Meta. Investors may see these companies as primary beneficiaries in the social media space, driving up share prices in anticipation of user growth and increased market share.

Challenges and Considerations

While the potential ban could offer a tactical advantage to companies like Snapchat and Meta, it also presents challenges. These companies would need to innovate continually to satisfy the diverse needs of former TikTok users. Moreover, the legislative move against TikTok raises broader concerns about internet freedom and regulation, which could eventually impact other social media platforms as well.

Ethical and Regulatory Landscape

The controversy surrounding TikTok has highlighted the complex interplay between technology, politics, and user privacy. As Snapchat and Meta potentially benefit from TikTok’s troubles, they must also navigate the ethical and regulatory challenges that arise from increased scrutiny on data practices and content moderation.

Conclusion

In conclusion, while the legislative push against TikTok could destabilize the current social media hierarchy, it also presents significant opportunities for companies like Snapchat and Meta to capitalize on a potential market void. However, these gains are not without challenges, requiring careful strategic planning and responsive innovation to harness effectively. Investors and market analysts will be watching closely as this situation develops, potentially reshaping the competitive dynamics of the social media industry.

Business

YUUUUGE, $DJT TMTG Launches Live TV Streaming Platform via Truth Social

DO NOT MISS THIS FREE OPPORTUNITY!

ARE YOU A TRADER?

DO YOU WANT FREE STOCK PICKS?

CHECK THIS OUT….

Ready to elevate your trading game with the next big winner? Don’t miss out – join the savvy investors who are already benefiting from our Wall St veteran’s free SMS alerts. Act now! Sign up at https://slktxt.io/ZmRx or send ‘FREE’ to 844-722-9743 and be the first to get the insider scoop on what’s hot in the market

Trump Media & Technology Group Corp. (NASDAQ:DJT), known as TMTG, has officially concluded the research and development phase for its innovative live TV streaming platform. This development marks a significant step for the operator of the social media platform, Truth Social. After six months of rigorous testing across its Web and iOS platforms, TMTG is now set to expand its content delivery network (CDN), enhancing the platform’s streaming capabilities.

Strategic Rollout in Phases

TMTG’s rollout of its streaming service is planned in three strategic phases, designed to broaden its reach and accessibility:

- Phase 1: Integration of the CDN with the Truth Social app, extending live TV streaming services to users on Android, iOS, and Web.

- Phase 2: The launch of standalone over-the-top (OTT) streaming apps for mobile devices and tablets, facilitating easier access to the platform’s content.

- Phase 3: Expansion to home television systems by introducing streaming apps compatible with various home TV setups.

Diverse and Inclusive Content Offering

The new streaming platform is set to host a variety of content, including live TV, news networks, religious channels, and family-friendly programming such as films and documentaries. TMTG aims to serve as a sanctuary for content and creators at risk of cancellation or suppression on other platforms, promising a safe haven for free expression and diverse viewpoints.

A Commitment to High-Quality Streaming and Free Speech

Devin Nunes, CEO of TMTG, expressed his enthusiasm for the project, highlighting the platform’s commitment to providing a permanent home for high-quality news and entertainment. “We want to let these creators know they’ll soon have a guaranteed platform where they won’t be cancelled,” said Nunes.

The CDN developed by TMTG is engineered to be user-friendly, cost-effective, and independent of Big Tech influences. It incorporates advanced technology designed to optimize video streaming speed, performance, and security while minimizing disruptions. This initiative is expected to substantially enhance the user experience on Truth Social, reinforcing the platform’s mission of promoting free speech and serving its robust community of users and supporters.

Conclusion: A Strategic Expansion by TMTG

As TMTG transitions into the next phase of its development with the rollout of its live TV streaming platform, the company is poised to make significant impacts in the media and technology landscape. This expansion not only diversifies TMTG’s offerings but also strengthens its position as a champion of free speech and alternative media. The strategic development of its CDN and phased rollout plan demonstrates TMTG’s commitment to growth and innovation, potentially setting new standards in the streaming content arena.

-

Markets3 months ago

Markets3 months agoThe AI Revolution: How Super Micro Computer (SMCI) Skyrocketed in the Tech Rally

-

Trading3 months ago

Trading3 months ago3 Must-Watch AI Stocks in 2024: Unveiling ShiftPixy, C3.ai, and CXApp’s Market Potential

-

Markets3 months ago

Markets3 months agoMastering the Market: A Guide to the Fundamentals of Value Investing

-

Lusso's Exclusives2 months ago

Lusso's Exclusives2 months agoWall Street Veteran Owns A Crap Ton Of Monday.com Stock [NASDAQ:MNDY]

-

Business3 months ago

Business3 months agoDeciphering HSBC Holdings plc’s Fiscal Landscape: An In-depth Analysis of 2023’s Outcomes

-

Markets3 months ago

Markets3 months agoPlus500 Ltd’s Financial Overview: A Glimpse into 2023’s Performance

-

Markets1 month ago

Markets1 month agoBoeing’s Proactive Measures Ahead of Whistleblower Hearing

-

Markets2 months ago

Markets2 months ago[BREAKING NEWS] ShiftPixy (PIXY): Poised for Explosive Growth with Strategic Acquisitions and $100 Million Financing

-

Lusso's Exclusives3 months ago

Lusso's Exclusives3 months agoTop Stocks to Watch Tomorrow: LQR, NVDA, SMCI, and HOLO

-

Markets1 month ago

Markets1 month agoUnitedHealth Group Demonstrates Resilience in Q1 2024 Financial Report

-

Markets2 months ago

Markets2 months agoFisker Inc.’s Abrupt End to Automaker Talks Sparks Industry Speculation