Business

AMD vs. Tesla: A Tale of AI and Market Dynamics

In the ever-evolving landscape of Wall Street, the story of General Electric’s fall from grace serves as a stark reminder of how quickly fortunes can change. It’s a narrative that resonates strongly with investors today, particularly when examining the trajectories of Advanced Micro Devices (NASDAQ: AMD) and Tesla (NASDAQ: TSLA). As we navigate through the shifts in market capitalization, a question emerges: could AMD outpace Tesla by 2025?

The Current State of Play

At present, Tesla’s market cap significantly overshadows that of AMD, standing at $598 billion compared to AMD’s $274 billion. This gap, however, narrows when we look back to their peak valuations. Tesla once boasted a market cap of $1.2 trillion, more than six times that of AMD. Yet, rewind further to 2020, and the two companies were almost neck and neck, each with a market cap of nearly $65 billion. Going even further back to 2012, AMD actually held the larger market cap, illustrating the fluid nature of company valuations.

The Ascendancy of AMD

The resurgence of AMD, closing the gap on Tesla, can largely be attributed to the burgeoning field of Artificial Intelligence (AI). In essence, both AMD and Tesla can be considered AI companies, albeit at different stages of AI integration. AMD, with its semiconductor designs, sits at the core of AI technology, supplying the crucial chips that giants like Microsoft and Meta Platforms are eagerly incorporating into their operations. Tesla’s AI ambitions, primarily focused on Full Self-Driving (FSD) and robotics, are still in the research and development phase, awaiting broader adoption.

AMD’s advantage lies in its current positioning within the AI adoption cycle. The company’s AI chips are in high demand, a testament to their immediate utility and integration into existing technologies. Tesla, meanwhile, is yet to transition its AI innovations from the drawing board to the market, with its immediate focus remaining on vehicle sales as a precursor to its AI-driven aspirations.

Tesla’s Challenges and AMD’s Opportunities

Tesla’s journey towards revolutionizing transportation with FSD and robotaxis has been fraught with delays, keeping investors on edge regarding the company’s AI milestones. These delays, coupled with concerns over declining gross margins and production estimates, have led to a comparative underperformance in Tesla’s stock.

Conversely, AMD’s trajectory is on an upward swing, fueled by the insatiable demand for AI chips. The company’s recent introduction of new accelerators poised to rival Nvidia’s dominance in the market highlights AMD’s aggressive push towards AI supremacy. This strategic positioning has seen AMD’s market cap surge by 49% over the last six months, while Tesla’s has dipped by 29%.

Looking Ahead

Should these trends persist, AMD and Tesla’s market capitalizations could converge by the end of summer 2024, a scenario that underscores the dynamic and unpredictable nature of stock market investments. While trends are not a foolproof basis for investment decisions, the shifting sands of AMD and Tesla’s market caps offer a compelling narrative of potential parity driven by advancements and adoptions in AI technology.

As we contemplate the future, it becomes evident that the realm of AI not only defines the strategic directions of AMD and Tesla but also embodies the broader market dynamics of innovation, adoption, and the relentless pursuit of technological leadership. For investors, the tale of AMD and Tesla serves as a vivid illustration of the importance of staying attuned to industry shifts, technological breakthroughs, and the ever-present potential for rapid change in the world of Wall Street.

DISCLAIMER

We the publisher (WE) offers no guarantees and provides forward looking statements with intentions and sole purpose to satisfy the reader/viewer by offering only personal enjoyment and personal entertainment. If at any time a Security is purchased that is discussed at WE on a written article, post, newsletter or comment, you agree to hold WE liability free and harmless. There are no guarantees in participating in Financial Markets and full investment can be fully lost at any time. WE never guarantees and never offers recommendations. The company will not be responsible for any loss or damage that occurs. Anyone at WE may be buying or selling any stock mentioned at any given time.

FOR EDUCATIONAL AND INFORMATION PURPOSES ONLY; NOT INVESTMENT ADVICE. Any WE Service and product offered is for educational and informational purposes only and should NOT be construed as a securities-related offer or solicitation, or be relied upon as personalized investment advice. WE recommend you consult a licensed or registered professional before making any investment decision as you could lose your full investment at any given time as this is not a “risk free” industry. If you do agree to this, then please exit our website now.

WE are NOT AN INVESTMENT ADVISOR OR REGISTERED BROKER. Both, WE nor any of its owners or employees are registered as a securities broker-dealer, broker, investment advisor (IA), or IA representative with the U.S. Securities and Exchange Commission, any state securities regulatory authority, or any self-regulatory organization. We do NOT give out advice, this is intended to be ONLY a publication for information and education.

PAID ADVERTISEMENT

Lusso’s News, LLC has been compensated $15,000 by a third party for marketing services on behalf of Shiftpixy [NASDAQ: PIXY]. This compensation covers the period from January 1, 2024, to April 1, 2024`. In the interest of transparency, it is important to note that Lusso’s News, LLC may receive additional advertising revenue from new advertisers and may collect email addresses from readers, which could be monetized.

Investors and readers are advised to consider this information carefully and conduct their own due diligence before making any investment decisions. This advertisement and other marketing efforts may contribute to increased investor and market awareness, potentially leading to a rise in the number of shareholders and trading activities related to the securities of PIXY.

It should be understood that any increases in trading volume or share price as a result of this advertisement and marketing efforts may be temporary and may decline once the advertising arrangement concludes. Lusso’s News, LLC aims to provide accurate and unbiased information, but readers are encouraged to verify details and seek professional advice before making any financial decisions related to the mentioned securities.

Please be aware that investing involves risks, and past performance is not indicative of future results. Always consider consulting with a qualified financial advisor before making investment decisions. Lusso’s News, LLC may be buying or selling anytime.

Business

Mortgage Rates Hit 7.1%: Analyzing the Impact on the U.S. Housing Market

DO NOT MISS THIS FREE OPPORTUNITY!

ARE YOU A TRADER?

DO YOU WANT FREE STOCK PICKS?

CHECK THIS OUT….

Ready to elevate your trading game with the next big winner? Don’t miss out – join the savvy investors who are already benefiting from our Wall St veteran’s free SMS alerts. Act now! Sign up at https://slktxt.io/ZmRx or send ‘FREE’ to 844-722-9743 and be the first to get the insider scoop on what’s hot in the market

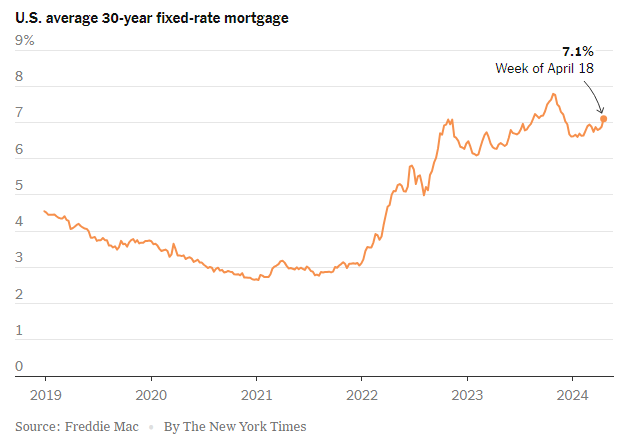

The U.S. housing market is experiencing significant pressure as mortgage rates have surged past the 7 percent mark for the first time this year. According to a recent report by Freddie Mac, the average rate on the 30-year mortgage, the most favored home loan across the nation, climbed to 7.1 percent this week, marking the highest level since last November. This spike poses a considerable challenge to millions of potential home buyers and could further slow down a market already showing signs of cooling.

Rising Rates and Their Ripple Effects

Last year, mortgage rates peaked at nearly 8 percent, a height unseen since 2000. This upward trend in rates began in 2021, significantly driven by Federal Reserve policies aimed at curbing inflation through higher benchmark interest rates. Despite a reduction in inflation rates, they remain above the Fed’s 2 percent target, leading to expectations that high borrowing costs may persist.

The immediate effect of these climbing rates is twofold. Firstly, potential home buyers face increased costs, making homeownership less accessible for many Americans. This economic strain is causing prospective buyers to deliberate intensely on whether to purchase now or delay in hopes of a rate decrease later in the year.

Secondly, existing homeowners, who secured their properties at lower interest rates, are reluctant to sell, fearing higher rates on a new mortgage. This hesitancy to sell is contributing to a decreased housing supply, inadvertently pushing home prices up despite fewer transactions.

Market Slowdown and Policy Responses

Data from the National Association of Realtors (NAR) underscores the market’s response to these economic pressures, with sales of existing homes dropping by 4.3 percent in March and 3.7 percent year-over-year. This downturn reflects broader economic frustrations and the daunting prospect of entering a market characterized by both high prices and high rates.

In a potentially mitigating development, the NAR recently agreed to settle litigation that would eliminate the standard real estate sales commission. Traditionally, sellers would pay a 5 to 6 percent commission, a cost typically passed on to buyers, inflating home prices. This change could, theoretically, reduce overall home purchasing costs.

Broader Economic Implications

The rising mortgage rates, coupled with the Fed’s indications of maintaining a high-interest rate environment, have pushed Treasury yields higher, influencing mortgage rates further. The 10-year Treasury yield has notably increased to about 4.6 percent since the start of the year.

As the market adjusts to these new economic realities, the overarching question remains: How many potential buyers can withstand further rate increases? Freddie Mac’s chief economist, Sam Khater, suggests that the future of the housing market is still very much uncertain, with potential buyers weighing the risks of higher future costs against the possibility of rate decreases.

Conclusion

The surge in mortgage rates above 7 percent represents more than just a numerical threshold; it is a significant barrier to entry for many Americans aspiring to homeownership. This development tests the resilience of the U.S. housing market and calls for close monitoring of future economic policies and market adaptations. As the landscape evolves, potential homebuyers and industry stakeholders alike must navigate these challenging waters with careful consideration and strategic planning.

Business

Potential Ban on TikTok: A Boon for Snapchat and Meta?

DO NOT MISS THIS FREE OPPORTUNITY!

ARE YOU A TRADER?

DO YOU WANT FREE STOCK PICKS?

CHECK THIS OUT….

Ready to elevate your trading game with the next big winner? Don’t miss out – join the savvy investors who are already benefiting from our Wall St veteran’s free SMS alerts. Act now! Sign up at https://slktxt.io/ZmRx or send ‘FREE’ to 844-722-9743 and be the first to get the insider scoop on what’s hot in the market

The U.S. House of Representatives’ recent move to potentially ban TikTok via legislation could have significant implications for the competitive landscape of social media, particularly benefiting companies like Snapchat and Meta (formerly Facebook). This legislative effort, part of a broader package for Israel and Ukraine, underscores growing concerns about TikTok’s Chinese ownership and its implications for national security.

Strategic Advantage for Competitors

Snapchat and Meta, two of the largest social media platforms in the United States, stand to gain from a TikTok ban. TikTok, with its 170 million U.S. users, has become a dominant force in social media, particularly among younger audiences who engage with its dynamic content ranging from dance videos to political discourse. A ban could leave a vast user base seeking alternative platforms, and Snapchat and Meta are well-positioned to absorb this migration.

1. User Engagement and Growth

Both Snapchat and Meta have been investing heavily in video and augmented reality—technologies at the heart of TikTok’s appeal. Snapchat’s innovative AR filters and Meta’s investment in Reels and virtual reality could see increased user engagement as TikTok users look for similar experiences elsewhere.

2. Advertising Revenue

A shift in user base would also likely lead to an increase in advertising revenue for Snapchat and Meta. Advertisers looking to capitalize on the highly engaged, predominantly younger audience that TikTok attracted would turn to these platforms, which offer robust ad-targeting systems and massive global reach.

3. Market Position and Shares

From a financial perspective, the potential TikTok ban could lead to a bullish outlook for stocks like Snapchat and Meta. Investors may see these companies as primary beneficiaries in the social media space, driving up share prices in anticipation of user growth and increased market share.

Challenges and Considerations

While the potential ban could offer a tactical advantage to companies like Snapchat and Meta, it also presents challenges. These companies would need to innovate continually to satisfy the diverse needs of former TikTok users. Moreover, the legislative move against TikTok raises broader concerns about internet freedom and regulation, which could eventually impact other social media platforms as well.

Ethical and Regulatory Landscape

The controversy surrounding TikTok has highlighted the complex interplay between technology, politics, and user privacy. As Snapchat and Meta potentially benefit from TikTok’s troubles, they must also navigate the ethical and regulatory challenges that arise from increased scrutiny on data practices and content moderation.

Conclusion

In conclusion, while the legislative push against TikTok could destabilize the current social media hierarchy, it also presents significant opportunities for companies like Snapchat and Meta to capitalize on a potential market void. However, these gains are not without challenges, requiring careful strategic planning and responsive innovation to harness effectively. Investors and market analysts will be watching closely as this situation develops, potentially reshaping the competitive dynamics of the social media industry.

Business

YUUUUGE, $DJT TMTG Launches Live TV Streaming Platform via Truth Social

DO NOT MISS THIS FREE OPPORTUNITY!

ARE YOU A TRADER?

DO YOU WANT FREE STOCK PICKS?

CHECK THIS OUT….

Ready to elevate your trading game with the next big winner? Don’t miss out – join the savvy investors who are already benefiting from our Wall St veteran’s free SMS alerts. Act now! Sign up at https://slktxt.io/ZmRx or send ‘FREE’ to 844-722-9743 and be the first to get the insider scoop on what’s hot in the market

Trump Media & Technology Group Corp. (NASDAQ:DJT), known as TMTG, has officially concluded the research and development phase for its innovative live TV streaming platform. This development marks a significant step for the operator of the social media platform, Truth Social. After six months of rigorous testing across its Web and iOS platforms, TMTG is now set to expand its content delivery network (CDN), enhancing the platform’s streaming capabilities.

Strategic Rollout in Phases

TMTG’s rollout of its streaming service is planned in three strategic phases, designed to broaden its reach and accessibility:

- Phase 1: Integration of the CDN with the Truth Social app, extending live TV streaming services to users on Android, iOS, and Web.

- Phase 2: The launch of standalone over-the-top (OTT) streaming apps for mobile devices and tablets, facilitating easier access to the platform’s content.

- Phase 3: Expansion to home television systems by introducing streaming apps compatible with various home TV setups.

Diverse and Inclusive Content Offering

The new streaming platform is set to host a variety of content, including live TV, news networks, religious channels, and family-friendly programming such as films and documentaries. TMTG aims to serve as a sanctuary for content and creators at risk of cancellation or suppression on other platforms, promising a safe haven for free expression and diverse viewpoints.

A Commitment to High-Quality Streaming and Free Speech

Devin Nunes, CEO of TMTG, expressed his enthusiasm for the project, highlighting the platform’s commitment to providing a permanent home for high-quality news and entertainment. “We want to let these creators know they’ll soon have a guaranteed platform where they won’t be cancelled,” said Nunes.

The CDN developed by TMTG is engineered to be user-friendly, cost-effective, and independent of Big Tech influences. It incorporates advanced technology designed to optimize video streaming speed, performance, and security while minimizing disruptions. This initiative is expected to substantially enhance the user experience on Truth Social, reinforcing the platform’s mission of promoting free speech and serving its robust community of users and supporters.

Conclusion: A Strategic Expansion by TMTG

As TMTG transitions into the next phase of its development with the rollout of its live TV streaming platform, the company is poised to make significant impacts in the media and technology landscape. This expansion not only diversifies TMTG’s offerings but also strengthens its position as a champion of free speech and alternative media. The strategic development of its CDN and phased rollout plan demonstrates TMTG’s commitment to growth and innovation, potentially setting new standards in the streaming content arena.

-

Markets3 months ago

Markets3 months agoThe AI Revolution: How Super Micro Computer (SMCI) Skyrocketed in the Tech Rally

-

Lusso's Exclusives2 months ago

Lusso's Exclusives2 months agoWall Street Veteran Owns A Crap Ton Of Monday.com Stock [NASDAQ:MNDY]

-

Markets3 months ago

Markets3 months agoMastering the Market: A Guide to the Fundamentals of Value Investing

-

Trading3 months ago

Trading3 months ago3 Must-Watch AI Stocks in 2024: Unveiling ShiftPixy, C3.ai, and CXApp’s Market Potential

-

Business3 months ago

Business3 months agoDeciphering HSBC Holdings plc’s Fiscal Landscape: An In-depth Analysis of 2023’s Outcomes

-

Markets3 months ago

Markets3 months agoPlus500 Ltd’s Financial Overview: A Glimpse into 2023’s Performance

-

Markets1 month ago

Markets1 month agoBoeing’s Proactive Measures Ahead of Whistleblower Hearing

-

Markets2 months ago

Markets2 months ago[BREAKING NEWS] ShiftPixy (PIXY): Poised for Explosive Growth with Strategic Acquisitions and $100 Million Financing

-

Markets1 month ago

Markets1 month agoUnitedHealth Group Demonstrates Resilience in Q1 2024 Financial Report

-

Markets2 months ago

Markets2 months agoFisker Inc.’s Abrupt End to Automaker Talks Sparks Industry Speculation

-

Markets1 month ago

Markets1 month agoGlobe Life Inc. Issues Statement Refuting Short Seller Allegations