Commodities

Corn and Soybeans Trading Halts To The Upside Following USDA Data

Corn and Soybeans both reached limit up (halted to the upside) following lower than expected preliminary acreage estimates.

Soybeans limit up- +5.12%

Corn limit up +3.74%

Wheat is still trading but is currently up +3.74%

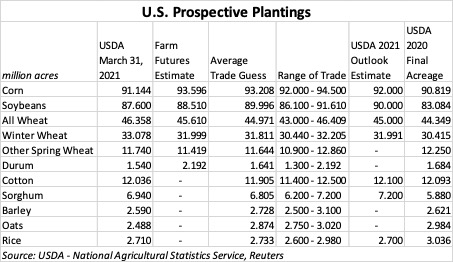

Corn is estimated around 91 million acres which is lower than the estimated of around 93 million acres.

The USDA report stated “Corn planted area for all purposes in 2021 is estimated at 91.1 million acres, up less than 1 percent or an increase of 325,000 acres from last year. Compared with last year, planted acreage is expected to be up or unchanged in 24 of the 48 estimated States.”

“Planted acreage for 2021 is expected to be up or unchanged from 2020 in 24 of the 48 estimating States. Record high acreage is expected in Idaho and Oregon. Record low acreage is expected in Massachusetts and Rhode Island. Acreage increases from last year of 100,000 or more are expected Louisiana, Mississippi, North Dakota, South Dakota, Tennessee, and Wisconsin,” comments in the USDA report.

Soybeans is estimated around 87 million acres which is lower than the estimated numbers of around 89.9 million acres. Soybeans reached limit up as trading halted for the day following the report.

The USDA report stated, “Soybean planted area for 2021 is estimated at 87.6 million acres, up 5 percent from last year. Compared with last year, planted acreage is up or unchanged in 23 of the 29 estimating States.”

Comments in the USDA report on soybeans, “Growers intend to plant 87.6 million acres in 2021, up 5 percent from last year. Compared with last year, planted acreage intentions are up or unchanged in 23 of the 29 estimating States. Increases of 250,000 acres or more are anticipated in Illinois, Iowa, Minnesota, Nebraska, North Dakota, South Dakota, and Wisconsin. If realized, the planted area in Kentucky, Pennsylvania, South Dakota, and Wisconsin will be the largest on record.”

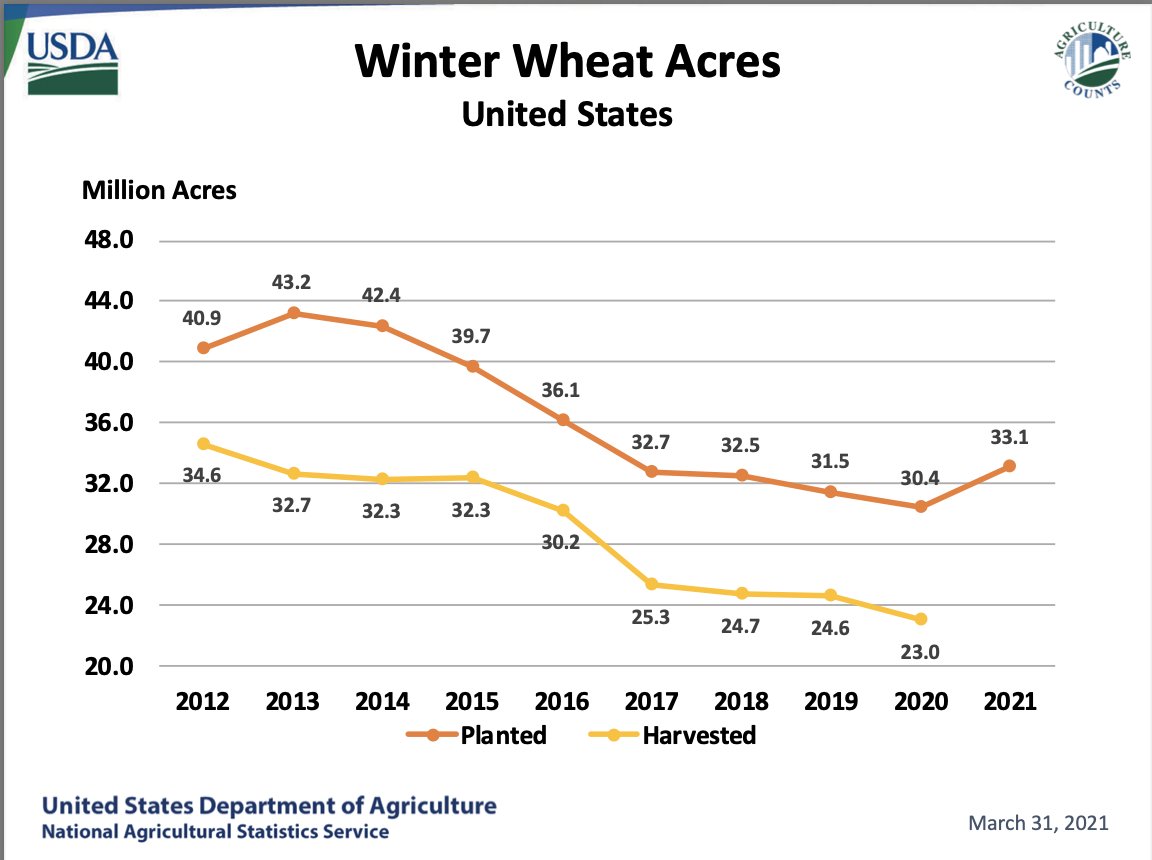

Wheat continues to trade as it has not reach limit up yet. Wheat is trading higher on the day even though it actually reported higher than estimated acreages. The USDA report coming in around 46 million acres while the estimated numbers were around 45 million acres.

The USDA report stated, “All wheat planted area for 2021 is estimated at 46.4 million acres, up 5 percent from 2020. This represents the fourth lowest all wheat planted area since records began in 1919. The 2021 winter wheat planted area, at 33.1 million acres, is up 9 percent from last year and up 3 percent from the previous estimate. Of this total, about 23.2 million acres are Hard Red Winter, 6.42 million acres are Soft Red Winter, and 3.48 million acres are White Winter. Area expected to be planted to other spring wheat for 2021 is estimated at 11.7 million acres, down 4 percent from 2020. Of this total, about

10.9 million acres are Hard Red Spring wheat. Durum planted area for 2021 is expected to total 1.54 million acres, down 9 percent from the previous year.”

Commodities

Commodities: Soybeans Is Trading Near A Key Level

Grains have saw a BOOM and as commodities tend to trade, we should expect a BUST, right? Well maybe that is not the case yet because Soybeans in trading near a very important level.

Soybeans is trading over 100 points off of Mays low as it is inching closer to the key $1,800 area.

As you can see the chart above, you can see that around 2012 Soybeans was trading near the current levels it is trading at.

This key area is going to be $1789 and above this level could be a nice breakout potentially.

Right now Soybeans currently trades at $1705 but, it has been consolidating for a few weeks now as it has traded in a range around $1600-$1700.

Commodities

Wheat Breakouts Out Of Channel…AGAIN

Wheat Futures saw a gap up as futures opened last night.

This came after it broke out on Thursday and it has gained momentum Friday followed by a gap up on Sunday.

Get Our Free Report

Commodities

Soybeans Trying to Breakout Over $1600

It has been quite the ride for Soybean traders the past few months as it has gone from $1600 back down to $1200 and now back at $1600.

The question is will it be a double top or will it actually breakout above $1600 this time.

First, I want to give credit to our very own @ChartBreakouts on twitter for calling this breakout via twitter.

The Chart

Since Soybeans had bottomed around $1200 it had broken out and not looked back. As you can see this current area is very strong resistance from a few months back and all eyes will be on the $1600 area.

Earlier this week Soybeans did try to gain momentum over $1600 but that was not long lived and in result it fell back below $1600.

This morning Soybeans is currently trading around $1599 and is on watch today to see if demand can come into it and push it higher

Come Join Our PRO Report

We are offering 20% off for LIFE as well with VERY COMPETITVE PRICING: Powerhouse.Substack.com/SPECIAL

5 Benefits of turning Pro

- High level Customer Service Via Whatsapp and Email.

- Multiple Reports Per Week With Customer Service for Extra Clarity.

- Institutional Quality Research and Commentary on Stocks, Futures, Options

- Very Cheaply Priced!

- Access To Features To Come (webinars, Videos, Conference Calls,etc…

We are offering 20% off for LIFE as well with VERY COMPETITVE PRICING: Powerhouse.Substack.com/SPECIAL

-

Markets3 months ago

Markets3 months agoUnderstanding Viking Therapeutics’ Position in the Biopharma Sector: A Beginner’s Guide

-

Markets3 months ago

Markets3 months agoThe AI Revolution: How Super Micro Computer (SMCI) Skyrocketed in the Tech Rally

-

Trading2 months ago

Trading2 months ago3 Must-Watch AI Stocks in 2024: Unveiling ShiftPixy, C3.ai, and CXApp’s Market Potential

-

Markets3 months ago

Markets3 months agoMastering the Market: A Guide to the Fundamentals of Value Investing

-

Lusso's Exclusives2 months ago

Lusso's Exclusives2 months agoWall Street Veteran Owns A Crap Ton Of Monday.com Stock [NASDAQ:MNDY]

-

Business3 months ago

Business3 months agoDeciphering HSBC Holdings plc’s Fiscal Landscape: An In-depth Analysis of 2023’s Outcomes

-

Markets3 months ago

Markets3 months agoPlus500 Ltd’s Financial Overview: A Glimpse into 2023’s Performance

-

Markets2 months ago

Markets2 months ago[BREAKING NEWS] ShiftPixy (PIXY): Poised for Explosive Growth with Strategic Acquisitions and $100 Million Financing

-

Markets3 weeks ago

Markets3 weeks agoBoeing’s Proactive Measures Ahead of Whistleblower Hearing

-

Lusso's Exclusives3 months ago

Lusso's Exclusives3 months agoTop Stocks to Watch Tomorrow: LQR, NVDA, SMCI, and HOLO

-

Markets3 weeks ago

Markets3 weeks agoUnitedHealth Group Demonstrates Resilience in Q1 2024 Financial Report