Markets

Crocs (CROX) Gains As Market Sells; What You Should Know

Shares of Crocs Inc [NASDAQ: CROX] traded over +1.8% higher today despite the S&P 500 closing near the lows down around -0.8%. The company is seeing their stock rally and near the all-time highs as it currently trades around $144 and the all-time high is around $148.

The S&P 500 finished down around -1.69% for the week while CROX finished up over +3% for the week.

So Why Is CROX Strong?

The growth story on CROX has been the main story for the company. The last 3 quarters the company has seen triple digit percentage increases on their Earnings Per Share (EPS). The growth in the quarterly EPS year-over-year has been large with gains over 700%, 500% and 100%.

That is not all though, the company has seen their sales increase as well the last 3 quarters with gains over 50% in all three quarters year-over-year.

Looking at the Earnings Per Share annually, the company has seen nearly 100% increase in yearly EPS for 4 quarters in a row. This year (2021) their are estimated to see a increase of around 108%.

The last 4 quarters, the number of funds has also seen a increase.

50 Day Moving Average

The 50 day moving average has held multiple times in this current uptrend since 2020. As of recent it recently did test this level (blue line on chart above) and it did hold it once again as a level of support.

Now the stock is nearing new highs as it trades around $4 from the highs.

The bottom line is this stock has been strong when the market has been weak. It will be interesting to see how this stock acts when the market is strong.

“Our Q2 results are exceptional as we continue to see strong demand for the Crocs brand globally. Our confidence in the strength of our brand is also reflected in our raised 2021 guidance.” Andrew Rees, President, CEO & Director of Crocs

The companies CEO was very optimistic on the earnings call in July, “I’m excited for our future, and I’m confident we can deliver sustained, highly profitable growth while having a positive impact on our planet and our communities.”

They Are Seeing Growth Across The Board

“Revenue growth was strong across all regions, with the Americas up 136%. And on a constant-currency basis, EMEA up 53% and Asia up 27%. Sandals, one of our long-term growth pillars, grew by 57% in the second quarter and 38% for the first half. Digital sales grew by 25% versus prior year and an impressive 99% versus 2019 to represent 36% of revenues.”

Adjusted operating income more than doubled to $196 million, and adjusted operating margins expanded to a record of 31%. Adjusted diluted earnings per share increased by $1.22 to $2.23. Underlying these incredible results is the iconic brand we have built.- Andrew Rees, CEO of Crocs

They Are Doing What I Love…Paying Influencers To Market Their Product..

The CEO said this on the companies earnings call and this is music to my ears:

“To continue to fuel brand relevance and consideration globally, we leverage digital and social marketing, influencer campaigns, and collaborations. We were the first footwear brand to market an augmented reality experience on TikTok, with our #GetCrocd Challenge, featuring try-on sandals and clogs for Jibbitz. Globally, this drove over 8 billion views and over 1 million users of the hashtag. We also generated buzz when Balenciaga Spring 2022 runway featured our second collaboration together, comprised of a knee-high rain boot and a Croc stiletto.”Andrew Rees

Notes/Quotes from CEO:

- “Finally, in the U.S., we reintroduced our Free Pair for Healthcare initiative during National Nurses Week, where we gave away 50,000 pairs of Crocs at-work shoes to frontline caregivers.”

- “This week, we announced our next step in having a positive impact on our planet. Our commitment to becoming a net-zero emissions by 2030.”

- “We continue to innovate and are encouraged by the initial results of our new platform and seasonal colors and prints. “

- ” Digital remains a top priority, and we continue to invest in our customer experience globally to retain our competitive advantage relative to other footwear brands. “

Notes/Quotes from CFO on Companies Earnings Call:

- “We delivered record quarterly revenues on broad-based growth across all regions, channels, and product pillars.”

- Expanded Gross Margins

- “We will continue to prioritize investment in the business to support our future growth.”

Guidance:

- “Due to the lack of visibility, we have provided guidance with potential supply chain disruptions and additional expense in mind. For Q3, we expect revenue to grow approximately 60% to 70% and adjusted operating margin to expand to be between 24% and 26%.”

- Raising Full Year Guidance

- Strong growth is expected in all regions and all channels as brand momentum continues. Given our extraordinary first-half performance and confidence in the momentum of the Crocs brand, we are raising full-year 2021 guidance. We now expect 2021 revenue to grow between 60% and 65%. And the midpoint growth in the second half is anticipated to be 49% versus 2020 and 100% versus 2019.

*Investor Day on September 14 For Crocs*

Contact: info@lussosnews.com

*Article is not investment advice, author holds 0 shares of Crocs at the time this article was published but may be buying or selling at any time.

Markets

The Most Shorted Stocks as of Late March 2024

DO NOT MISS THIS FREE OPPORTUNITY!

ARE YOU A TRADER?

DO YOU WANT FREE STOCK PICKS?

CHECK THIS OUT….

Ready to elevate your trading game with the next big winner? Don’t miss out – join the savvy investors who are already benefiting from our Wall St veteran’s free SMS alerts. Act now! Sign up at https://slktxt.io/ZmRx or send ‘FREE’ to 844-722-9743 and be the first to get the insider scoop on what’s hot in the market

Short selling is a strategy used by investors who believe that a stock’s price will decline, allowing them to buy it back at a lower price in the future. Market participants closely watch the most shorted stocks as they can be indicative of market sentiment or potential volatility. Based on the latest data from MarketWatch, here are the stocks with the highest short interest as of March 28, 2024.

1. IMAC Holdings Inc. (NASDAQ: BACK)

- Price: $3.30

- 1-Day Change: +6.80%

- Year-To-Date Change: +49.32%

- Short Interest: 880,148 shares

- Percent of Float Shorted: 93.92%

IMAC Holdings stands out with a massive 93.92% of its float being shorted, indicating significant bearish sentiment despite a strong year-to-date performance.

2. XTI Aerospace Inc. (OTC: XTIA)

- Price: $2.86

- 1-Day Change: +5.15%

- Year-To-Date Change: -49.11%

- Short Interest: 381,503 shares

- Percent of Float Shorted: 78.91%

XTI Aerospace has seen nearly 79% of its float shorted amidst a substantial decline in its stock price this year.

3. SunPower Corp. (NASDAQ: SPWR)

- Price: $1.96

- 1-Day Change: -8.41%

- Year-To-Date Change: -59.42%

- Short Interest: 39,254,967 shares

- Percent of Float Shorted: 76.64%

SunPower, a solar energy company, faces skepticism with over three-quarters of its float shorted following a sharp drop in its stock price.

4. BYND Cannasoft Enterprises Inc. (NASDAQ: BCAN)

- Price: $0.97

- 1-Day Change: +6.61%

- Year-To-Date Change: -98.50%

- Short Interest: 410,370 shares

- Percent of Float Shorted: 75.67%

BYND Cannasoft has witnessed an extreme decline in its price this year, coupled with a high short interest.

5. B. Riley Financial Inc. (NASDAQ: RILY)

- Price: $21.72

- 1-Day Change: +0.84%

- Year-To-Date Change: +3.48%

- Short Interest: 12,260,125 shares

- Percent of Float Shorted: 75.47%

B. Riley Financial appears more resilient, showing a positive year-to-date return, yet it still faces significant short pressure.

Other Notable Mentions:

- Biomea Fusion Inc. (NASDAQ: BMEA), Arbor Realty Trust Inc. (NYSE: ABR), and MicroCloud Hologram Inc. (NASDAQ: HOLO) also feature in the top 10 most shorted stocks, with short interests ranging from 41% to 48%.

Analysis:

Investors short sell stocks for various reasons, including speculation on price declines or hedging against potential downturns. The companies listed above are experiencing significant short interest, which could lead to price volatility, particularly if there is a sudden positive shift in their fundamentals, possibly leading to a short squeeze.

It’s essential for investors to conduct thorough research and consider multiple factors when investing in or short selling stocks, especially those with high short interest, as they can be particularly volatile.

Markets

Understanding a Flash Crash in the Stock Market

DO NOT MISS THIS FREE OPPORTUNITY!

ARE YOU A TRADER?

DO YOU WANT FREE STOCK PICKS?

CHECK THIS OUT….

Ready to elevate your trading game with the next big winner? Don’t miss out – join the savvy investors who are already benefiting from our Wall St veteran’s free SMS alerts. Act now! Sign up at https://slktxt.io/ZmRx or send ‘FREE’ to 844-722-9743 and be the first to get the insider scoop on what’s hot in the market

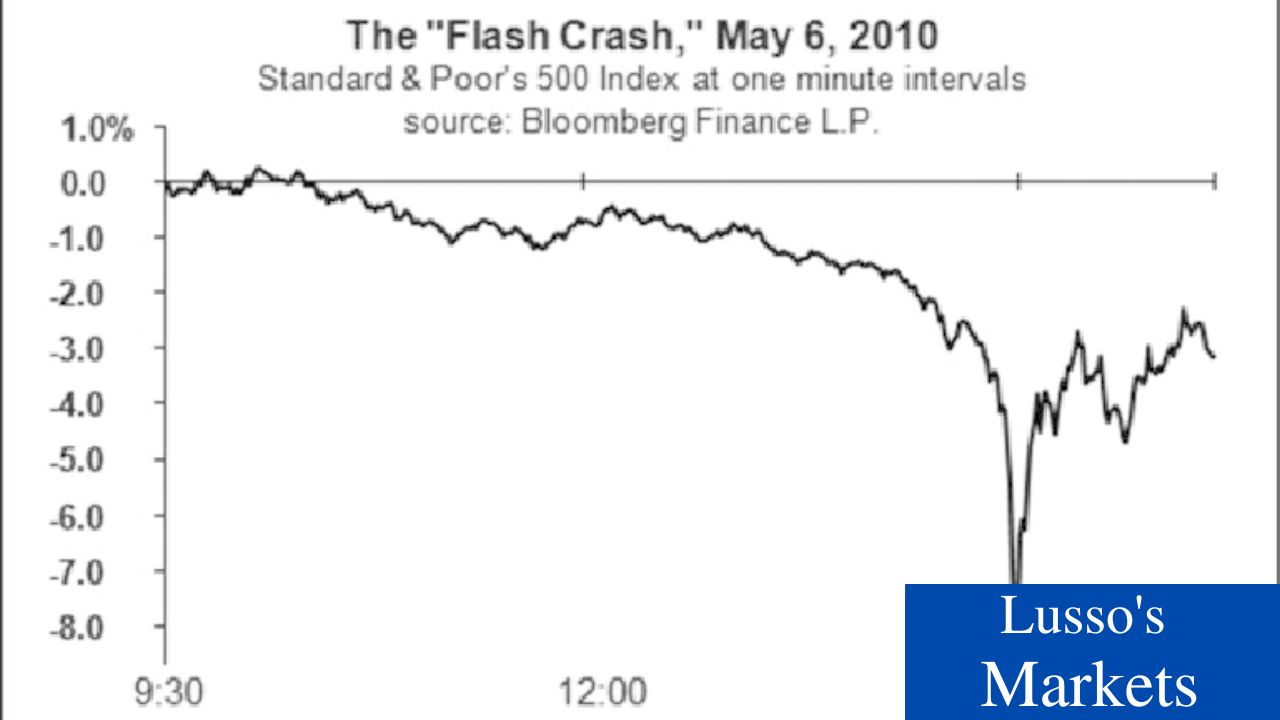

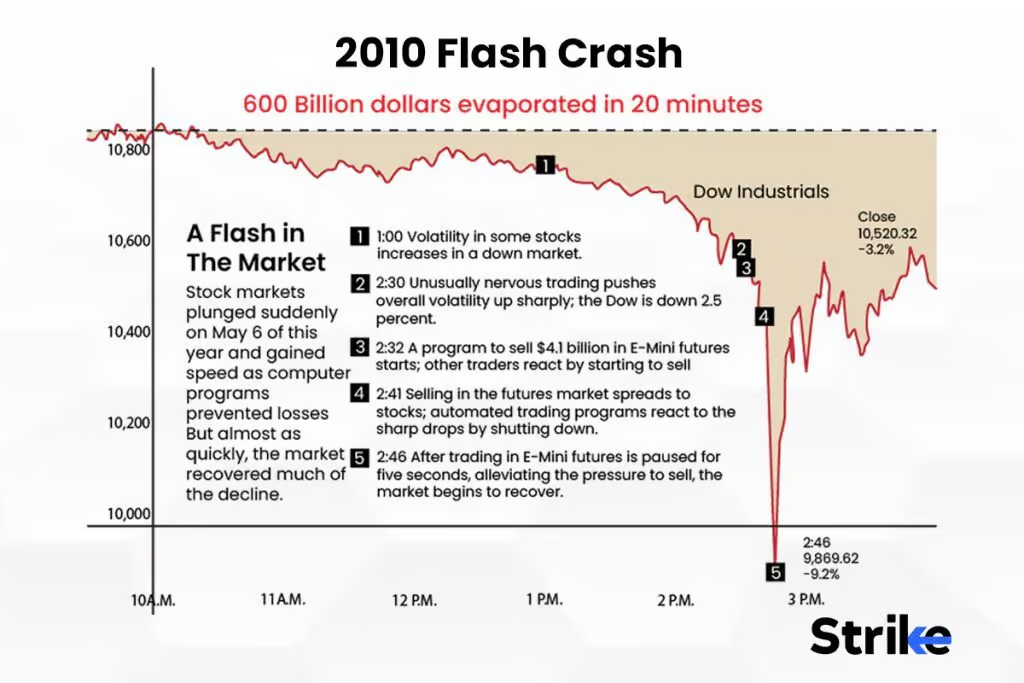

In the fast-paced world of finance, few events can instill as much immediate fear and confusion as a “flash crash.” This term describes an event where stock prices plummet sharply within an extremely short period—often just minutes—before often rebounding just as quickly. These rapid and dramatic movements can result in substantial market disruptions, affecting a wide range of assets including stocks, bonds, and commodities.

Origins of a Flash Crash

The concept of a flash crash became widely recognized after the most notorious example, which occurred on May 6, 2010. During this event, the Dow Jones Industrial Average fell about 1,000 points (over 9%) only to recover those losses within minutes. This sudden plunge and recovery highlighted inherent vulnerabilities in the market structures and systems.

Causes of Flash Crashes

Flash crashes can be triggered by a variety of factors, which often interact in complex ways:

- High-Frequency Trading (HFT): Many analysts attribute the rise of flash crashes to the increase in high-frequency trading, where firms use algorithms to execute millions of orders at lightning speed. These algorithms can sometimes create feedback loops if they start to sell off assets in a falling market, amplifying the initial decline.

- Market Structure Issues: The fragmentation of trading venues and the varying rules and technologies used by these platforms can also contribute to flash crashes. Disparities in trading rules and protocols can lead to situations where automated systems behave unpredictively or inefficiently.

- Liquidity Crunches: Flash crashes are often exacerbated by a sudden lack of liquidity. As prices begin to fall, automatic stop-loss orders can trigger further selling, but if there aren’t enough buyers, prices can drop precipitously.

- News and Social Media: Sometimes, an erroneous news report or a significant surge in social media activity can spur rapid trading actions by algorithms that parse news and data for trading signals.

Impact and Responses

The impact of a flash crash is broad. In the short term, investors can see huge losses, and confidence in the markets can wane. For traders, the volatility can result in significant financial damage, especially for those who are unable to react quickly enough to the abrupt price changes.

In response to flash crashes, regulatory bodies have implemented several measures to prevent or mitigate their effects. For example, after the 2010 crash, the U.S. Securities and Exchange Commission (SEC) introduced “circuit breakers” that temporarily halt trading in a stock if its price drops too quickly.

Preventative Measures

Beyond regulatory changes, there’s also a push for improved risk management strategies within trading firms, especially those employing high-frequency trading algorithms. These measures include more sophisticated and robust systems to monitor and control trading activities and improved testing of algorithms to ensure they behave as expected during market stress.

The Ever-Evolving Market Dynamics

As markets evolve and the use of technology deepens, the potential for flash crashes remains significant. This necessitates continuous advances in both technology and regulation to safeguard against the risks posed by these rapid and unpredictable market events.

Understanding flash crashes is crucial for anyone involved in the trading world, from regulators and traders to ordinary investors trying to navigate the complexities of modern financial markets. Recognizing the signs and potential triggers of flash crashes can help market participants better prepare for and potentially avoid the risks associated with these startling events.

Markets

A Glimpse Into the Buzz of Upcoming IPOs in April 2024

DO NOT MISS THIS FREE OPPORTUNITY!

ARE YOU A TRADER?

DO YOU WANT FREE STOCK PICKS?

CHECK THIS OUT….

Ready to elevate your trading game with the next big winner? Don’t miss out – join the savvy investors who are already benefiting from our Wall St veteran’s free SMS alerts. Act now! Sign up at https://slktxt.io/ZmRx or send ‘FREE’ to 844-722-9743 and be the first to get the insider scoop on what’s hot in the market

The investment atmosphere is heating up with a series of intriguing initial public offerings (IPOs) set to hit the market in late April 2024. This month features a diverse lineup of companies poised to go public, ranging from technology innovators to international restaurant chains. Here’s a detailed look at some of the most anticipated IPOs.

Tungray Technologies Inc. (TRSG)

Exchange: NASDAQ Capital

Price: $4.00

Shares: 1,250,000

Expected IPO Date: 4/19/2024

Offer Amount: $5,000,000

Tungray Technologies is stepping into the public market with a modest offer amount. The company’s focus on innovative tech solutions might attract investors looking for new growth opportunities in the tech sector.

RanMarine Technology B.V. (RAN)

Exchange: NASDAQ Capital

Price: $5.50

Shares: 1,435,000

Expected IPO Date: 4/19/2024

Offer Amount: $9,076,375

RanMarine Technology, known for its advanced marine technology solutions, is also set for the same date. With a slightly higher offer amount, it shows potential for considerable market interest.

Sushi Ginza Onodera, Inc. (ONDR)

Exchange: NYSE MKT

Price Range: $7.00-$8.00

Shares: 1,066,667

Expected IPO Date: 4/19/2024

Offer Amount: $9,813,336.40

Offering a culinary twist to the IPO scene, Sushi Ginza Onodera is preparing to serve not just premium sushi but also potentially premium stock value.

mF International Ltd (MFI)

Exchange: NASDAQ Capital

Price Range: $4.00-$5.00

Shares: 1,560,000

Expected IPO Date: 4/22/2024

Offer Amount: $8,970,000

This global firm is entering the market with a flexible price range, suggesting a cautious yet optimistic approach towards investor reception.

YY Group Holding Ltd. (YYGH)

Exchange: NASDAQ Capital

Price Range: $4.00-$5.00

Shares: 1,500,000

Expected IPO Date: 4/22/2024

Offer Amount: $8,625,000

YY Group is another promising prospect with its roots in technology and digital transformation, aiming to capture the tech-savvy investor’s eye.

Key Mining Corp. (KMCM)

Exchange: NYSE MKT

Price: $2.25

Shares: 4,444,444

Expected IPO Date: 4/25/2024

Offer Amount: $11,499,999.80

Diving into natural resources, Key Mining is set for a significant offering, indicating robust investor confidence in its mining operations and commodity potential.

Marex Group plc (MRX)

Exchange: NASDAQ Global Select

Price Range: $18.00-$21.00

Shares: 15,384,615

Expected IPO Date: 4/25/2024

Offer Amount: $371,538,447

As one of the heaviest hitters this month, Marex Group plc commands attention with its substantial offer amount, reflecting its established market presence and investor trust.

Rubrik, Inc. (RBRK)

Exchange: NYSE

Price Range: $28.00-$31.00

Shares: 23,000,000

Expected IPO Date: 4/25/2024

Offer Amount: $819,950,000

Rubrik stands out with a massive offer, targeting tech investors interested in data management and cloud services, marking it as one of the blockbuster listings of the month.

Loar Holdings, LLC (LOAR)

Exchange: NYSE

Price Range: $24.00-$26.00

Shares: 11,000,000

Expected IPO Date: 4/26/2024

Offer Amount: $328,900,000

Loar Holdings is geared up to make a significant impact with its sizable offer, highlighting its robust positioning in the manufacturing sector.

ZenaTech, Inc. (ZENA)

Exchange: NASDAQ Capital

Expected IPO Date: 4/30/2024

Offer Amount: $7,100,900

Wrapping up the month, ZenaTech will test waters with a strategic focus on tech innovations, appealing to niche investors keen on cutting-edge technologies.

April 2024 is shaping up to be a dynamic month for the IPO market, showcasing a wide range of sectors and opportunities. Investors are advised to keep an eye on these dates and delve deeper into each company’s prospects before making investment decisions. Each of these companies presents unique opportunities and challenges, marking another exciting chapter in the financial markets.

-

Markets3 months ago

Markets3 months agoUnderstanding Viking Therapeutics’ Position in the Biopharma Sector: A Beginner’s Guide

-

Business3 months ago

Business3 months agoLQR HOUSE’s Sean Dollinger Teams Up with Michael Jordan’s Business Partner Bjarne Borg in Exclusive Interview

-

Markets2 months ago

Markets2 months agoThe AI Revolution: How Super Micro Computer (SMCI) Skyrocketed in the Tech Rally

-

Markets2 months ago

Markets2 months agoMastering the Market: A Guide to the Fundamentals of Value Investing

-

Trading2 months ago

Trading2 months ago3 Must-Watch AI Stocks in 2024: Unveiling ShiftPixy, C3.ai, and CXApp’s Market Potential

-

Lusso's Exclusives2 months ago

Lusso's Exclusives2 months agoWall Street Veteran Owns A Crap Ton Of Monday.com Stock [NASDAQ:MNDY]

-

Business2 months ago

Business2 months agoDeciphering HSBC Holdings plc’s Fiscal Landscape: An In-depth Analysis of 2023’s Outcomes

-

Markets2 months ago

Markets2 months agoPlus500 Ltd’s Financial Overview: A Glimpse into 2023’s Performance

-

Markets1 month ago

Markets1 month ago[BREAKING NEWS] ShiftPixy (PIXY): Poised for Explosive Growth with Strategic Acquisitions and $100 Million Financing

-

Markets2 weeks ago

Markets2 weeks agoBoeing’s Proactive Measures Ahead of Whistleblower Hearing

-

Lusso's Exclusives2 months ago

Lusso's Exclusives2 months agoTop Stocks to Watch Tomorrow: LQR, NVDA, SMCI, and HOLO

Pingback: EXCLUSIVE: Three Stocks To Watch This Week - Lusso's News