Markets

Dynatrace (DT) Has Wall Streets Attention; What You Should Know

Quick Take

- Raised Guidance

- Earnings Reported Strong Numbers

- 11th Consecutive Quarter expanding above 120%

[mstock id=”2114″]

Industry Group

Dynatrace Inc [NYSE: DT] is part of the Computer Software Enterprise industry group. This group has had a massive “bubble like” uptrend since the start of the pandemic. As this industry was a leader in 2020, in our opinion DT, did not follow suit in the inflated price action. DT, which was featured on our

report in the Fall of 2020 and had investors worried as their guidance, which was not “ideal” towards the end of 2020.

With the high competition for market share, DT was stuck trading sideways while the rest of the industry group was soaring to inflated prices with some trading at a P/E of over 400.

Is Emerging Tech in a Bubble?

Founder of Bridgewater Associates, Ray Dalio, showed an image in one of his Linked In posts “Are We In a Stock Market Bubble?” that emerging tech is having bubble- like characteristics. This could explain the weakness in the Nasdaq. As Jesse Livermore said,” the leaders of today may not be the leaders of tomorrow”.

DT, recent earnings report has investors attention. They had such a strong quarter in my opinion, that they decided to raise their guidance all across the board for fiscal 2021. Companies do not just raise their guidance for no reason. They are aware that an earnings miss could make the stock tank, so when companies raise guidance, especially in uncertain times, it has investors attention.

[mstock id=”2118″]

Earnings

- Subscription revenue was $170 million, up 33% year over year

- Unlevered cash flow was $74 million, brining year-to-date unlevered

free cash flow to $151 million or 30% of revenue - EPS increased 0.17 from 0.10 the prior year’s quarter. This was a

increase of 70% - Number of funds increased from 680 to 743 from the last quarter. This

shows more funds are taking positions into the stock - Annual EPS increased from 0.13 in 2019 to 0.30 in 2020 giving it a

over 100% increase. They are projected to increase over 100% in 2021

on their annual EPS

They are starting to get really aggressive. On their earnings call they stated that they are “doubling down in several key areas to take advantage of the market momentum and opportunity”.

“We’ve kept our foot on the gas throughout the pandemic and are now scaling up commercial expansion to capture greater share and drive continued strong growth “the CEO said on the earnings call.

- They added 189 new companies in the past quarter which is back

above Pre-Pandemic levels. - “We maintained a net expansion rate above 120% for the 11th

consecutive quarter.” - 33% of their customers now are using three-plus modules, up from

24% a year ago. And nearly 40% are now using their infrastructure

module for some non-full stack workloads that support their cloud

operations, such as directories, firewalls, load balancers and more.

Post Pandemic Rise?

Around 20% of their enterprise customers were in industries that were facing “headwinds” due to Covid-19. These industries include Travel, hospitality and Automotive.

With the economy starting to open up as vaccines roll out it will be interesting to see if demand from these industries see an increase in sales for DT.

Getting By In The Pandemic

- “Overall, revenue came in well above our guidance due to some FX tailwinds. But more importantly than that, we saw strength in all areas, including new bookings, strong linearity and solid retention rates that drove revenue and ARR outperformance.”

- “total non-GAAP gross margin for the third quarter was 85%, in line with last quarter and up over 1 percentage point from Q3 of last year.”

- “non-GAAP operating margin of 29%, up 3 percentage points from the third quarter of last year.

- “we had $300 million of cash, an increase of $111 million compared to

the same period last year. Our ability to generate cash while investing

in the business remains strong.”

Guidance

- ARR is expected to be between $756 million and $760 million, up 32% to 33% year over year.

- ARR growth rate is expected to be roughly 32% year over year on a constant currency basis.

- “For the fourth quarter, we expect total revenue to be between $190 million and $192 million, up 26% to 28% year over year or 23% to 24% in constant currency.”

- Subscription revenue is expected to be between $178 million and $180 million, up 32% to 33% year over year.

- “From a profit standpoint, non-GAAP operating income is expected to be between $44 million and $46 million, 23% to 24% of revenue and non-GAAP EPS of $0.13 to $0.14 per share.”

- “Total revenue for the full year is expected to be $697 million to $699 million, up 28% year over year, 27% in constant currency.”

- “Subscription revenue is expected to be between $650 million and $652 million for the Full Year, up 33% to 34% year over year or 32% in constant currency.”

- Full Year non-GAAP operating income to be between $202 million and $204 million and non-GAAP EPS of $0.61 to $0.62 per share.

- “Raising our unlevered free cash flow margin guidance to approximately 32% of fiscal ’21 revenue.”

Technical Opinion on DT

- Daily MACD which is used as a momentum indicator is nearing a potential bullish convergence.

- It held old resistance as new support during a time the Nasdaq was weak.

- Using the three most recent peaks of lower highs to form a trendline,

DT shows it has now broken that trend line but, the concern is that it

only had average volume which could make it more prone to a pullback

in our opinion. - What to look for now, is for it to make a higher high and higher low as

it breaks through this trendline

Markets

The Most Shorted Stocks as of Late March 2024

DO NOT MISS THIS FREE OPPORTUNITY!

ARE YOU A TRADER?

DO YOU WANT FREE STOCK PICKS?

CHECK THIS OUT….

Ready to elevate your trading game with the next big winner? Don’t miss out – join the savvy investors who are already benefiting from our Wall St veteran’s free SMS alerts. Act now! Sign up at https://slktxt.io/ZmRx or send ‘FREE’ to 844-722-9743 and be the first to get the insider scoop on what’s hot in the market

Short selling is a strategy used by investors who believe that a stock’s price will decline, allowing them to buy it back at a lower price in the future. Market participants closely watch the most shorted stocks as they can be indicative of market sentiment or potential volatility. Based on the latest data from MarketWatch, here are the stocks with the highest short interest as of March 28, 2024.

1. IMAC Holdings Inc. (NASDAQ: BACK)

- Price: $3.30

- 1-Day Change: +6.80%

- Year-To-Date Change: +49.32%

- Short Interest: 880,148 shares

- Percent of Float Shorted: 93.92%

IMAC Holdings stands out with a massive 93.92% of its float being shorted, indicating significant bearish sentiment despite a strong year-to-date performance.

2. XTI Aerospace Inc. (OTC: XTIA)

- Price: $2.86

- 1-Day Change: +5.15%

- Year-To-Date Change: -49.11%

- Short Interest: 381,503 shares

- Percent of Float Shorted: 78.91%

XTI Aerospace has seen nearly 79% of its float shorted amidst a substantial decline in its stock price this year.

3. SunPower Corp. (NASDAQ: SPWR)

- Price: $1.96

- 1-Day Change: -8.41%

- Year-To-Date Change: -59.42%

- Short Interest: 39,254,967 shares

- Percent of Float Shorted: 76.64%

SunPower, a solar energy company, faces skepticism with over three-quarters of its float shorted following a sharp drop in its stock price.

4. BYND Cannasoft Enterprises Inc. (NASDAQ: BCAN)

- Price: $0.97

- 1-Day Change: +6.61%

- Year-To-Date Change: -98.50%

- Short Interest: 410,370 shares

- Percent of Float Shorted: 75.67%

BYND Cannasoft has witnessed an extreme decline in its price this year, coupled with a high short interest.

5. B. Riley Financial Inc. (NASDAQ: RILY)

- Price: $21.72

- 1-Day Change: +0.84%

- Year-To-Date Change: +3.48%

- Short Interest: 12,260,125 shares

- Percent of Float Shorted: 75.47%

B. Riley Financial appears more resilient, showing a positive year-to-date return, yet it still faces significant short pressure.

Other Notable Mentions:

- Biomea Fusion Inc. (NASDAQ: BMEA), Arbor Realty Trust Inc. (NYSE: ABR), and MicroCloud Hologram Inc. (NASDAQ: HOLO) also feature in the top 10 most shorted stocks, with short interests ranging from 41% to 48%.

Analysis:

Investors short sell stocks for various reasons, including speculation on price declines or hedging against potential downturns. The companies listed above are experiencing significant short interest, which could lead to price volatility, particularly if there is a sudden positive shift in their fundamentals, possibly leading to a short squeeze.

It’s essential for investors to conduct thorough research and consider multiple factors when investing in or short selling stocks, especially those with high short interest, as they can be particularly volatile.

Markets

Understanding a Flash Crash in the Stock Market

DO NOT MISS THIS FREE OPPORTUNITY!

ARE YOU A TRADER?

DO YOU WANT FREE STOCK PICKS?

CHECK THIS OUT….

Ready to elevate your trading game with the next big winner? Don’t miss out – join the savvy investors who are already benefiting from our Wall St veteran’s free SMS alerts. Act now! Sign up at https://slktxt.io/ZmRx or send ‘FREE’ to 844-722-9743 and be the first to get the insider scoop on what’s hot in the market

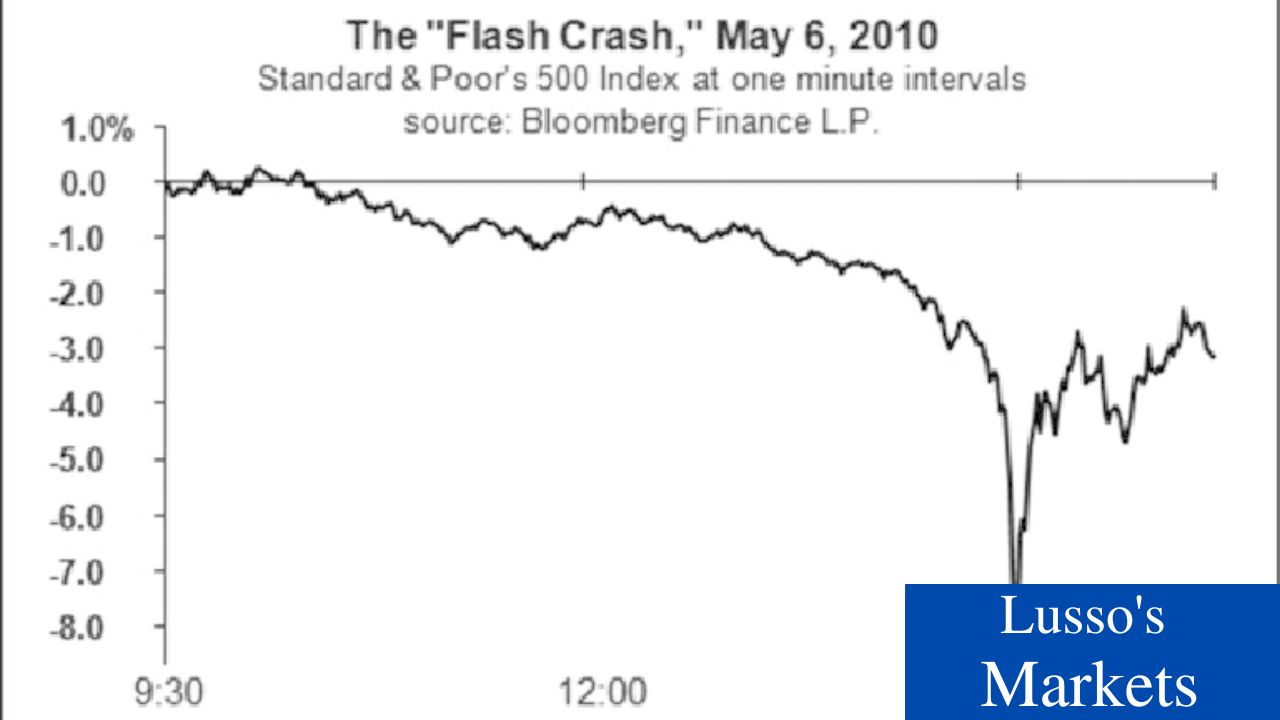

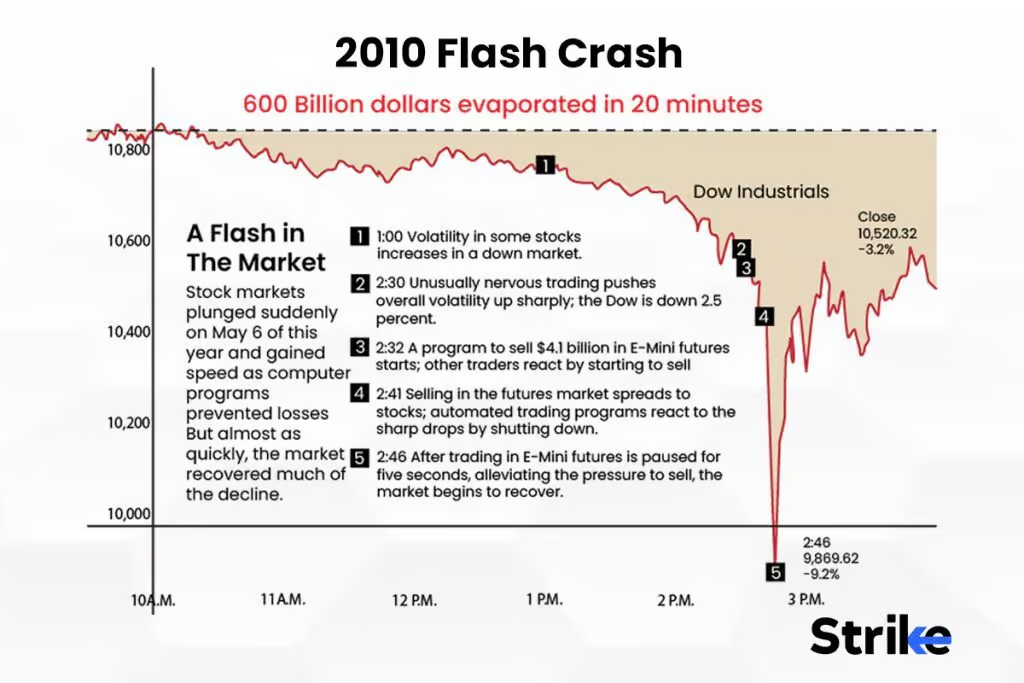

In the fast-paced world of finance, few events can instill as much immediate fear and confusion as a “flash crash.” This term describes an event where stock prices plummet sharply within an extremely short period—often just minutes—before often rebounding just as quickly. These rapid and dramatic movements can result in substantial market disruptions, affecting a wide range of assets including stocks, bonds, and commodities.

Origins of a Flash Crash

The concept of a flash crash became widely recognized after the most notorious example, which occurred on May 6, 2010. During this event, the Dow Jones Industrial Average fell about 1,000 points (over 9%) only to recover those losses within minutes. This sudden plunge and recovery highlighted inherent vulnerabilities in the market structures and systems.

Causes of Flash Crashes

Flash crashes can be triggered by a variety of factors, which often interact in complex ways:

- High-Frequency Trading (HFT): Many analysts attribute the rise of flash crashes to the increase in high-frequency trading, where firms use algorithms to execute millions of orders at lightning speed. These algorithms can sometimes create feedback loops if they start to sell off assets in a falling market, amplifying the initial decline.

- Market Structure Issues: The fragmentation of trading venues and the varying rules and technologies used by these platforms can also contribute to flash crashes. Disparities in trading rules and protocols can lead to situations where automated systems behave unpredictively or inefficiently.

- Liquidity Crunches: Flash crashes are often exacerbated by a sudden lack of liquidity. As prices begin to fall, automatic stop-loss orders can trigger further selling, but if there aren’t enough buyers, prices can drop precipitously.

- News and Social Media: Sometimes, an erroneous news report or a significant surge in social media activity can spur rapid trading actions by algorithms that parse news and data for trading signals.

Impact and Responses

The impact of a flash crash is broad. In the short term, investors can see huge losses, and confidence in the markets can wane. For traders, the volatility can result in significant financial damage, especially for those who are unable to react quickly enough to the abrupt price changes.

In response to flash crashes, regulatory bodies have implemented several measures to prevent or mitigate their effects. For example, after the 2010 crash, the U.S. Securities and Exchange Commission (SEC) introduced “circuit breakers” that temporarily halt trading in a stock if its price drops too quickly.

Preventative Measures

Beyond regulatory changes, there’s also a push for improved risk management strategies within trading firms, especially those employing high-frequency trading algorithms. These measures include more sophisticated and robust systems to monitor and control trading activities and improved testing of algorithms to ensure they behave as expected during market stress.

The Ever-Evolving Market Dynamics

As markets evolve and the use of technology deepens, the potential for flash crashes remains significant. This necessitates continuous advances in both technology and regulation to safeguard against the risks posed by these rapid and unpredictable market events.

Understanding flash crashes is crucial for anyone involved in the trading world, from regulators and traders to ordinary investors trying to navigate the complexities of modern financial markets. Recognizing the signs and potential triggers of flash crashes can help market participants better prepare for and potentially avoid the risks associated with these startling events.

Markets

A Glimpse Into the Buzz of Upcoming IPOs in April 2024

DO NOT MISS THIS FREE OPPORTUNITY!

ARE YOU A TRADER?

DO YOU WANT FREE STOCK PICKS?

CHECK THIS OUT….

Ready to elevate your trading game with the next big winner? Don’t miss out – join the savvy investors who are already benefiting from our Wall St veteran’s free SMS alerts. Act now! Sign up at https://slktxt.io/ZmRx or send ‘FREE’ to 844-722-9743 and be the first to get the insider scoop on what’s hot in the market

The investment atmosphere is heating up with a series of intriguing initial public offerings (IPOs) set to hit the market in late April 2024. This month features a diverse lineup of companies poised to go public, ranging from technology innovators to international restaurant chains. Here’s a detailed look at some of the most anticipated IPOs.

Tungray Technologies Inc. (TRSG)

Exchange: NASDAQ Capital

Price: $4.00

Shares: 1,250,000

Expected IPO Date: 4/19/2024

Offer Amount: $5,000,000

Tungray Technologies is stepping into the public market with a modest offer amount. The company’s focus on innovative tech solutions might attract investors looking for new growth opportunities in the tech sector.

RanMarine Technology B.V. (RAN)

Exchange: NASDAQ Capital

Price: $5.50

Shares: 1,435,000

Expected IPO Date: 4/19/2024

Offer Amount: $9,076,375

RanMarine Technology, known for its advanced marine technology solutions, is also set for the same date. With a slightly higher offer amount, it shows potential for considerable market interest.

Sushi Ginza Onodera, Inc. (ONDR)

Exchange: NYSE MKT

Price Range: $7.00-$8.00

Shares: 1,066,667

Expected IPO Date: 4/19/2024

Offer Amount: $9,813,336.40

Offering a culinary twist to the IPO scene, Sushi Ginza Onodera is preparing to serve not just premium sushi but also potentially premium stock value.

mF International Ltd (MFI)

Exchange: NASDAQ Capital

Price Range: $4.00-$5.00

Shares: 1,560,000

Expected IPO Date: 4/22/2024

Offer Amount: $8,970,000

This global firm is entering the market with a flexible price range, suggesting a cautious yet optimistic approach towards investor reception.

YY Group Holding Ltd. (YYGH)

Exchange: NASDAQ Capital

Price Range: $4.00-$5.00

Shares: 1,500,000

Expected IPO Date: 4/22/2024

Offer Amount: $8,625,000

YY Group is another promising prospect with its roots in technology and digital transformation, aiming to capture the tech-savvy investor’s eye.

Key Mining Corp. (KMCM)

Exchange: NYSE MKT

Price: $2.25

Shares: 4,444,444

Expected IPO Date: 4/25/2024

Offer Amount: $11,499,999.80

Diving into natural resources, Key Mining is set for a significant offering, indicating robust investor confidence in its mining operations and commodity potential.

Marex Group plc (MRX)

Exchange: NASDAQ Global Select

Price Range: $18.00-$21.00

Shares: 15,384,615

Expected IPO Date: 4/25/2024

Offer Amount: $371,538,447

As one of the heaviest hitters this month, Marex Group plc commands attention with its substantial offer amount, reflecting its established market presence and investor trust.

Rubrik, Inc. (RBRK)

Exchange: NYSE

Price Range: $28.00-$31.00

Shares: 23,000,000

Expected IPO Date: 4/25/2024

Offer Amount: $819,950,000

Rubrik stands out with a massive offer, targeting tech investors interested in data management and cloud services, marking it as one of the blockbuster listings of the month.

Loar Holdings, LLC (LOAR)

Exchange: NYSE

Price Range: $24.00-$26.00

Shares: 11,000,000

Expected IPO Date: 4/26/2024

Offer Amount: $328,900,000

Loar Holdings is geared up to make a significant impact with its sizable offer, highlighting its robust positioning in the manufacturing sector.

ZenaTech, Inc. (ZENA)

Exchange: NASDAQ Capital

Expected IPO Date: 4/30/2024

Offer Amount: $7,100,900

Wrapping up the month, ZenaTech will test waters with a strategic focus on tech innovations, appealing to niche investors keen on cutting-edge technologies.

April 2024 is shaping up to be a dynamic month for the IPO market, showcasing a wide range of sectors and opportunities. Investors are advised to keep an eye on these dates and delve deeper into each company’s prospects before making investment decisions. Each of these companies presents unique opportunities and challenges, marking another exciting chapter in the financial markets.

-

Markets3 months ago

Markets3 months agoThe AI Revolution: How Super Micro Computer (SMCI) Skyrocketed in the Tech Rally

-

Lusso's Exclusives2 months ago

Lusso's Exclusives2 months agoWall Street Veteran Owns A Crap Ton Of Monday.com Stock [NASDAQ:MNDY]

-

Markets3 months ago

Markets3 months agoMastering the Market: A Guide to the Fundamentals of Value Investing

-

Trading3 months ago

Trading3 months ago3 Must-Watch AI Stocks in 2024: Unveiling ShiftPixy, C3.ai, and CXApp’s Market Potential

-

Business3 months ago

Business3 months agoDeciphering HSBC Holdings plc’s Fiscal Landscape: An In-depth Analysis of 2023’s Outcomes

-

Markets3 months ago

Markets3 months agoPlus500 Ltd’s Financial Overview: A Glimpse into 2023’s Performance

-

Markets1 month ago

Markets1 month agoBoeing’s Proactive Measures Ahead of Whistleblower Hearing

-

Markets2 months ago

Markets2 months ago[BREAKING NEWS] ShiftPixy (PIXY): Poised for Explosive Growth with Strategic Acquisitions and $100 Million Financing

-

Lusso's Exclusives3 months ago

Lusso's Exclusives3 months agoTop Stocks to Watch Tomorrow: LQR, NVDA, SMCI, and HOLO

-

Markets1 month ago

Markets1 month agoUnitedHealth Group Demonstrates Resilience in Q1 2024 Financial Report

-

Markets2 months ago

Markets2 months agoFisker Inc.’s Abrupt End to Automaker Talks Sparks Industry Speculation