Lusso's Exclusives

Exclusive: Ulta Beauty (ULTA) Breakouts Out Of A Multi-Month Range

Shares of Ulta Beauty [NASDAQ:ULTA] are trading higher today as the stock breaks into 52 week high territory.

This stock was featured on Lusso’s Financial and Research Report which you can subscribe to at Powerhouse.Substack.com/SPECIAL.

The Chart

Looking at the weekly chart we can see that the stock as broken into new 52 week high territory today. This comes after a healthy multi month pullback.

With mask coming off the demand for make up and cosmetics could see a boom and in result ULTA remains on high alert as it is breaking out into new 52 week high territory.

Lusso's Exclusives

RESEARCH: 2 High Growth Stocks Nearing Technical Breakouts

Investment Overview

The travel and leisure industry has long been a barometer of consumer confidence and economic health. Post-pandemic, this sector is not just rebounding; it’s redefining the parameters of growth and investment potential. Investors seeking opportunities in this space often employ the CANSLIM methodology, a system based on a blend of quantitative and qualitative factors that gauge a company’s future prospects. CANSLIM stands for Current Earnings, Annual Earnings, New, Supply and Demand, Leader or Laggard, Institutional Sponsorship, and Market Direction. When applied to the travel and leisure sector, this methodology not only identifies promising stocks but also captures the prevailing sentiment and trajectory of the industry.

Industry Resurgence

As the world emerges from the constraints of the global health crisis, the pent-up demand for travel and leisure activities has propelled a robust recovery and growth phase. The resurgence is fueled by an appetite for experiential spending, rejuvenated global mobility, and a shift towards digital and sustainable tourism. Companies that adapted swiftly to the changing landscape by innovating customer experiences, leveraging technology, and expanding their global footprint are now at the forefront of the industry’s resurgence.

The CANSLIM Perspective

Through the lens of CANSLIM, this report will scrutinize two key players in the industry—Royal Caribbean Cruises (RCL) and Trip.com Group Limited (TCOM). Both entities have demonstrated strong quarterly and annual earnings growth, introduced new products and services, and witnessed favorable supply and demand dynamics. As leaders in their respective markets with substantial institutional sponsorship, their performances offer insights into the broader industry’s strengths and the market direction.

In the following sections, we will discuss the specifics of each company’s performance, strategies, and outlooks, providing a comprehensive analysis that reflects the vibrancy and potential of the travel and leisure industry in a post-pandemic world.

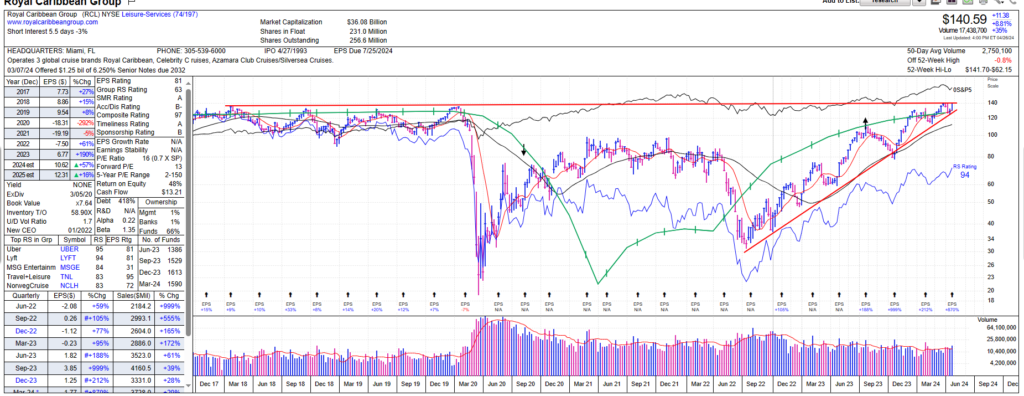

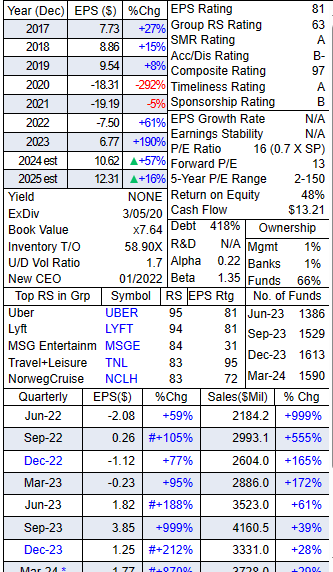

Research Report: Royal Caribbean Cruises (RCL)

Executive Summary

Royal Caribbean Cruises has reported a stellar performance in the first quarter of 2024, surpassing expectations set by management and analysts alike. As the travel and leisure industry continues its recovery trajectory post-pandemic, RCL has not only capitalized on this resurgence but has also strategically positioned itself to take advantage of the growing $1.9 trillion global vacation market.

CANSLIM Overview

- Current Quarterly Earnings: RCL reported adjusted earnings per share of $1.77, which is a 36% increase from the forecasted $1.30.

- Annual Earnings Growth: There has been a robust yield growth of 19.3% compared to the first quarter of 2023.

- New Product or Service: The introduction of the revolutionary Icon of the Seas has contributed to record-breaking bookings.

- Supply and Demand: Share supply may tighten as demand grows, indicated by increased bookings and 107% load factor.

- Leader or Laggard: RCL is outpacing the industry with strong demand across all key itineraries and destinations, notably in North America.

- Institutional Sponsorship: Institutional ownership is strong, with a noted increase in fund sponsorship.

- Market Direction: RCL is benefiting from a general upward market trend in the leisure and travel sector, with consumer spending on experiences doubling that of goods.

Strong Financial Performance

Royal Caribbean has successfully achieved a 107% load factor, and the demand environment continues to strengthen. The trifecta goals set by the company are now expected to be met in 2024, a year earlier than initially anticipated.

Expansion and Market Penetration

RCL’s expansion into the China market with Spectrum of the Seas and the planned addition of Ovation of the Seas in 2025 signifies the company’s confidence in and commitment to the Asia-Pacific region. In North America, the Caribbean itineraries, supported by new hardware like the Utopia of the Seas, are driving strong yield growth.

Strategic Innovations

The launch of private destinations such as the Royal Beach Club in Cozumel, Mexico, is enhancing guest experiences and is a pivotal element in competing against land-based vacations, potentially capturing a larger market share.

Focus on Sustainability

RCL’s sustainability efforts, highlighted in their 16th annual sustainability report, showcase their commitment to net-zero emissions and community impact, which is increasingly important to environmentally conscious travelers.

Technical Analysis

Referring to the image, RCL stock appears to be at a critical junction on the weekly chart, hovering around the $140 mark. The data suggests a pivotal area where the stock’s future price movement can be significantly influenced by upcoming trends and investor sentiment.

Conclusion

Given the robust quarterly results, strategic initiatives, and positive outlook shared in the earnings call, Royal Caribbean Cruises stands out as a compelling investment opportunity for CANSLIM traders. The company’s focus on delivering exceptional vacation experiences and its dedication to expanding its footprint in the global vacation market may bode well for its future stock performance.

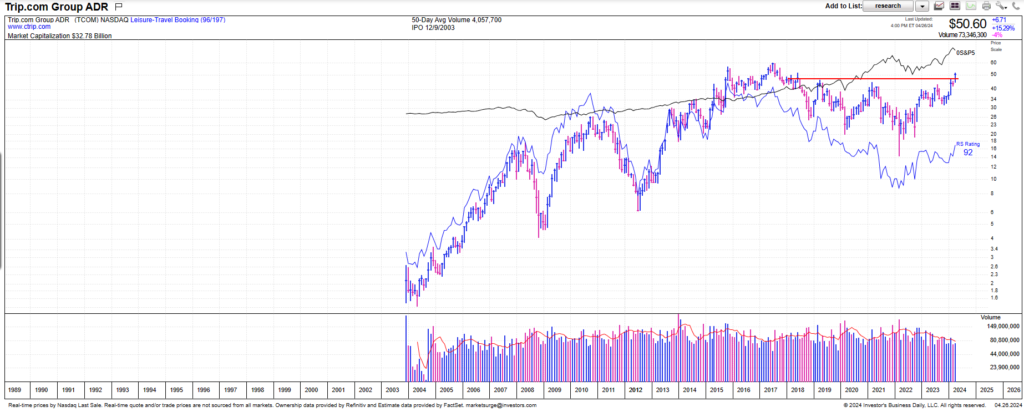

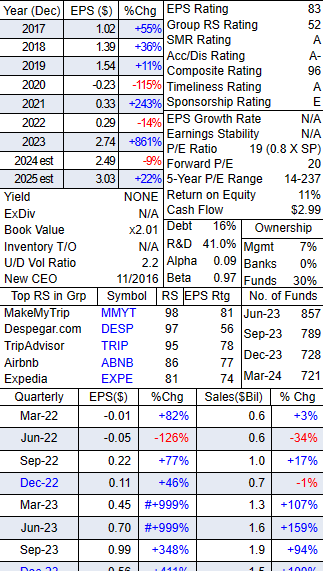

Research Report: Trip.com Group Limited (TCOM)

Executive Summary

Trip.com Group Limited (TCOM) has released its fourth quarter and full-year earnings for 2023, revealing substantial growth and robust recovery in the travel sector. The earnings call, led by Executive Chairman James Liang, CEO Jane Sun, and CFO Cindy Wang, highlighted a year marked by strategic expansions and customer-centric innovations. The company’s success is underpinned by the resurgence of China’s outbound travel and the strength of its global OTA platform. The company reports earnings again towards the end of May.

Overview and Financial Highlights

- Revenue Growth: Trip.com showcased a 105% year-over-year increase in Q4 2023 revenue, reaching RMB 10.3 billion. The full-year revenue was RMB 44.5 billion, a 122% increase year-over-year and 25% higher than 2019 levels.

- Market Segments Performance: All market segments, including domestic, outbound, and Trip.com’s global platform, reported robust growth with outbound travel bookings recovering to over 80% of pre-pandemic levels.

- Global Expansion: The OTA platform operates in 39 countries, focusing on Asian markets and expanding global offerings.

- Innovation and AI: Launch of TripGenie, an AI assistant, and investment in AI for improved customer service and operational efficiency.

- Sustainability Initiatives: Implementation of carbon hotel standards, green flights, and environmentally conscious travel options.

Financial Analysis

- Adjusted EBITDA Margin: A significant improvement to 31% in 2023, the highest in a decade, indicative of effective cost optimization.

- Profitability: Diluted earnings per ordinary share and per ADS reached RMB 1.94, with non-GAAP figures at RMB 4 per ADS, showcasing strong profitability.

- Capital Returns: The company commenced stock buybacks, demonstrating confidence in its valuation and long-term prospects.

TCOM Stock Technical Analysis

Referring to the provided image, TCOM stock appears to have recently crossed a crucial price level of $50. This breakout suggests a bullish sentiment among investors, likely driven by the company’s strong earnings and optimistic outlook for continued growth in the travel sector.

Strategic Initiatives

- Globalization: Aiming for 15-20% revenue contribution from Trip.com in the next 3-5 years, with a focus on direct traffic and cross-selling to enhance marketing efficiencies.

- Inbound Travel: Capitalizing on China’s visa-free policies to boost inbound travel, aligning with the government’s 14th five-year plan.

- Technology: Continuing to innovate with AI-driven solutions to improve user experience and streamline travel planning.

Outlook

Trip.com Group Limited is poised for accelerated growth in 2024, building on the upward trajectory in the global travel market. The company’s strategic focus on globalization, digitalization, and service quality positions it well to capitalize on the pent-up demand for travel and the evolving preferences of travelers.

Lusso's Exclusives

Wall Street Veteran Owns A Crap Ton Of Monday.com Stock [NASDAQ:MNDY]

DO NOT MISS THIS FREE OPPORTUNITY!

ARE YOU A TRADER?

DO YOU WANT FREE STOCK PICKS?

CHECK THIS OUT….

Ready to elevate your trading game with the next big winner? Don’t miss out – join the savvy investors who are already benefiting from our Wall St veteran’s free SMS alerts. Act now! Sign up at https://slktxt.io/ZmRx or send ‘FREE’ to 844-722-9743 and be the first to get the insider scoop on what’s hot in the market

Buckle up, team, because we’ve got a wild ride on our hands with Monday.com [NASDAQ: MNDY], and it’s catching the big eyes on Wall Street. Word on the street is that a Wall Street hot shot hastaken a big stake, scooping up a crap ton of MNDY stock, and let’s just say, they might be onto something juicy.

Monday.com [NASDAQ: MNDY]: A Stock to Watch in 2024 – Stock Market Coffee

Riding High on Growth Waves

In the chaotic world that is the stock market, spotting the next big hitter is like finding a needle in a haystack. Enter Monday.com, the platform that’s turning heads faster than a free beer sign at a frat party. With a whopping 41% revenue growth in the books for FY 2023, it’s no wonder Wall Street’s finest are betting big. This isn’t just growth; it’s Hulk-smashing through expectations, and here’s the lowdown on why Monday.com is the stock to watch:

Epic Scorecard for FY 2023

- Fourth Quarter Frenzy: Q4 ’23 saw revenues hitting a cool $202.6 million. That’s a 35% jump from the year before, folks. Talk about making it rain.

- Annual Gold Rush: The full-year revenue? A staggering $729.7 million, marking a 41% increase. If Monday.com were a movie, it’d be breaking box office records.

- Gross Margin Greatness: With a 90% gross margin in Q4 ’23 and plans to keep it in the high 80s, we’re looking at LeBron-level efficiency here.

- Cash Flow Kings: $55.4 million in free cash flow for Q4 and a total of $204.9 million for the year? That’s not just good; it’s Scrooge McDuck diving into his money bin good.

Peering into the Crystal Ball: FY 2024

Monday.com isn’t just sitting pretty; they’re aiming for the stars with their FY 2024 projections. We’re talking a revenue forecast that’s looking to hit between $926 million to $932 million. With non-GAAP operating income potentially reaching up to $64 million and a free cash flow forecast that makes the heart sing, it’s clear Monday.com isn’t planning on slowing down anytime soon.

Charting the Course: Technicals That Talk

Now, for my chart junkies, Monday.com’s stock is like a coiled spring, ready to launch. Hovering near a breakout point at $231, the stock’s been playing it cool, but don’t be fooled. This consolidation is the calm before the storm, and a breakout here could see the stock soar faster than a SpaceX launch.

Why Monday.com is the MVP

Monday.com isn’t just beating the game; they’re changing it. In a world where uncertainty is the only certainty, this company’s smashing records like it’s going out of style. With a financial report card that’s the envy of its peers and a strategic vision that’s as sharp as a tack, Monday.com is the stock that’s got everyone from Wall Street sharks to the casual trader sitting up and taking notice.

Final Whistle

So, there you have it. Monday.com [NASDAQ: MNDY] isn’t just a stock; it’s a statement. With a blend of explosive growth, strategic genius, and a chart that’s whispering sweet nothings to traders, it’s the beacon for those looking to ride the wave of tech’s future. Whether you’re a grizzled market veteran or a newbie looking to make your mark, keeping an eye on Monday.com might just be the smartest play you make in 2024. Let the games begin!

DO NOT MISS THIS FREE OPPORTUNITY!

ARE YOU A TRADER?

DO YOU WANT FREE STOCK PICKS?

CHECK THIS OUT….

Ready to elevate your trading game with the next big winner? Don’t miss out – join the savvy investors who are already benefiting from our Wall St veteran’s free SMS alerts. Act now! Sign up at https://slktxt.io/ZmRx or send ‘FREE’ to 844-722-9743 and be the first to get the insider scoop on what’s hot in the market

Lusso's Exclusives

Top Stocks to Watch Tomorrow: LQR, NVDA, SMCI, and HOLO

DO NOT MISS THIS FREE OPPORTUNITY!

ARE YOU A TRADER?

DO YOU WANT FREE STOCK PICKS?

CHECK THIS OUT….

Ready to elevate your trading game with the next big winner? Don’t miss out – join the savvy investors who are already benefiting from our Wall St veteran’s free SMS alerts. Act now! Sign up at https://slktxt.io/ZmRx or send ‘FREE’ to 844-722-9743 and be the first to get the insider scoop on what’s hot in the market

As we look towards tomorrow, several stocks stand out due to their technical patterns, upcoming earnings reports, and recent price movements. Among these, our featured chart of the week is LQR House [NASDAQ: LQR], which is showcasing a textbook symmetrical triangle, indicating a potential breakout. Additionally, with Nvidia’s earnings on the horizon and the dramatic price movements of Super Micro Computer and HOL O, investors are presented with a variety of opportunities. Let’s dive into these top stocks to watch.

Featured Chart of the Week: LQR House [NASDAQ: LQR]

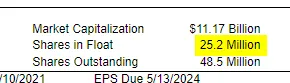

LQR House has captured the attention of the trading community, trading within a symmetrical triangle pattern and nearing a pivotal breakout level. This pattern, characterized by two converging trendlines, signifies a period of consolidation before a potential price breakout. LQR House’s low float and high popularity could fuel significant participation, potentially leading to a breakout. Traders should closely monitor the stock for any signs of increased volume or price movement beyond the triangle’s boundaries, which could indicate the start of a significant trend.

Nvidia [NASDAQ: NVDA]: Earnings Anticipation

Nvidia stands out as a key player in the tech sector, with its upcoming earnings report on Wednesday marking a critical event for the week. As one of the top earnings watchers, Nvidia’s financial performance can significantly impact its stock price and the broader market. Given the company’s influence in the semiconductor industry, positive or negative surprises in its earnings report could lead to substantial price movements. Investors should watch for any pre-earnings volatility and the company’s guidance for future quarters, which could offer insights into the tech sector’s health.

Super Micro Computer [NASDAQ: SMCI]: A Test of Support

Super Micro Computer has experienced a remarkable journey, soaring from $200 to over $1000 before facing a sharp decline on Friday. Currently, the stock is testing the 9-day exponential moving average (9EMA), a key technical indicator used by traders to gauge short-term momentum. Tuesday’s trading session will be critical for SMCI, as investors watch to see whether the stock holds above the 9EMA or breaks below, potentially signaling further declines. This level serves as a litmus test for the stock’s immediate direction and could influence investor sentiment.

HOLO: From Obscurity to Spotlight

HOLO’s meteoric rise from $2 to nearly $100 in just two weeks has been nothing short of spectacular, placing it firmly on traders’ radars. Currently, the stock is facing resistance, but a move above $75 could trigger a technical breakout, enticing more investors to jump in. This stock exemplifies the volatile nature of the market, where swift gains can capture widespread attention. Traders should monitor HOL O for any volume increases or price movements above resistance levels, which could indicate the start of another significant rally.

Bottom Line

As we approach tomorrow’s trading session, LQR House, Nvidia, Super Micro Computer, and HOL O stand out as top stocks to watch. Each presents unique opportunities and challenges, from LQR House’s potential breakout to Nvidia’s eagerly awaited earnings report, SMCI’s test of support, and HOL O’s resistance challenge. Investors and traders should remain vigilant, closely monitoring these stocks for signs of breakout, earnings surprises, or technical reversals. In the dynamic world of stock trading, staying informed and adaptable is key to capitalizing on opportunities as they arise.

DO NOT MISS THIS FREE OPPORTUNITY!

ARE YOU A TRADER?

DO YOU WANT FREE STOCK PICKS?

CHECK THIS OUT….

Ready to elevate your trading game with the next big winner? Don’t miss out – join the savvy investors who are already benefiting from our Wall St veteran’s free SMS alerts. Act now! Sign up at https://slktxt.io/ZmRx or send ‘FREE’ to 844-722-9743 and be the first to get the insider scoop on what’s hot in the market

DISCLAIMER

We the publisher (WE) offers no guarantees and provides forward looking statements with intentions and sole purpose to satisfy the reader/viewer by offering only personal enjoyment and personal entertainment. If at any time a Security is purchased that is discussed at WE on a written article, post, newsletter or comment, you agree to hold WE liability free and harmless. There are no guarantees in participating in Financial Markets and full investment can be fully lost at any time. WE never guarantees and never offers recommendations. The company will not be responsible for any loss or damage that occurs. Anyone at WE may be buying or selling any stock mentioned at any given time.

FOR EDUCATIONAL AND INFORMATION PURPOSES ONLY; NOT INVESTMENT ADVICE. Any WE Service and product offered is for educational and informational purposes only and should NOT be construed as a securities-related offer or solicitation, or be relied upon as personalized investment advice. WE recommend you consult a licensed or registered professional before making any investment decision as you could lose your full investment at any given time as this is not a “risk free” industry. If you do agree to this, then please exit our website now.

WE are NOT AN INVESTMENT ADVISOR OR REGISTERED BROKER. Both, WE nor any of its owners or employees are registered as a securities broker-dealer, broker, investment advisor (IA), or IA representative with the U.S. Securities and Exchange Commission, any state securities regulatory authority, or any self-regulatory organization. We do NOT give out advice, this is intended to be ONLY a publication for information and education.

PAID ADVERTISEMENT

Lusso’s News, LLC has been compensated $15,000 by a third party for marketing services on behalf of LQR House [NASDAQ: LQR]. This compensation covers the period from January 1, 2024, to April 1, 2024`. In the interest of transparency, it is important to note that Lusso’s News, LLC may receive additional advertising revenue from new advertisers and may collect email addresses from readers, which could be monetized.

Investors and readers are advised to consider this information carefully and conduct their own due diligence before making any investment decisions. This advertisement and other marketing efforts may contribute to increased investor and market awareness, potentially leading to a rise in the number of shareholders and trading activities related to the securities of LQR.

It should be understood that any increases in trading volume or share price as a result of this advertisement and marketing efforts may be temporary and may decline once the advertising arrangement concludes. Lusso’s News, LLC aims to provide accurate and unbiased information, but readers are encouraged to verify details and seek professional advice before making any financial decisions related to the mentioned securities.

Please be aware that investing involves risks, and past performance is not indicative of future results. Always consider consulting with a qualified financial advisor before making investment decisions. Lusso’s News, LLC may be buying or selling anytime.

-

Markets2 months ago

Markets2 months agoUnderstanding Viking Therapeutics’ Position in the Biopharma Sector: A Beginner’s Guide

-

Business3 months ago

Business3 months agoLQR HOUSE’s Sean Dollinger Teams Up with Michael Jordan’s Business Partner Bjarne Borg in Exclusive Interview

-

Markets2 months ago

Markets2 months agoThe AI Revolution: How Super Micro Computer (SMCI) Skyrocketed in the Tech Rally

-

Markets2 months ago

Markets2 months agoMastering the Market: A Guide to the Fundamentals of Value Investing

-

Trading2 months ago

Trading2 months ago3 Must-Watch AI Stocks in 2024: Unveiling ShiftPixy, C3.ai, and CXApp’s Market Potential

-

Lusso's Exclusives2 months ago

Lusso's Exclusives2 months agoWall Street Veteran Owns A Crap Ton Of Monday.com Stock [NASDAQ:MNDY]

-

Business2 months ago

Business2 months agoDeciphering HSBC Holdings plc’s Fiscal Landscape: An In-depth Analysis of 2023’s Outcomes

-

Markets2 months ago

Markets2 months agoPlus500 Ltd’s Financial Overview: A Glimpse into 2023’s Performance

-

Markets2 weeks ago

Markets2 weeks agoBoeing’s Proactive Measures Ahead of Whistleblower Hearing

-

Markets1 month ago

Markets1 month ago[BREAKING NEWS] ShiftPixy (PIXY): Poised for Explosive Growth with Strategic Acquisitions and $100 Million Financing

-

Lusso's Exclusives2 months ago

Lusso's Exclusives2 months agoTop Stocks to Watch Tomorrow: LQR, NVDA, SMCI, and HOLO