Markets

TSLA: Tesla Faces New Challenge with Controversial Full Self-Driving Ad During Super Bowl Sunday

[mstock id=”4401″]

Challenges and Distractions for Tesla

Electric car maker Tesla is facing various challenges and distractions at the moment, and this Super Bowl Sunday, it will face another one. California tech entrepreneur Dan O’Dowd, who has already invested millions of dollars in a campaign to ban Tesla’s Full Self-Driving technology from public roads, is funding a Super Bowl commercial that will play in the nation’s capital and in several state capitals including Austin, Tallahassee, Albany, Atlanta, and Sacramento.

Controversial Ad Campaign

The advertisement shows a Tesla Model 3 running into a child-sized mannequin with Full Self-Driving turned on. The vehicle crosses the centerline into oncoming traffic, ignores “do not enter” signs, drives past a school bus with flashing stop lights, and hits a stroller in the road. O’Dowd says he is making this investment in a new ad campaign to pressure politicians to make the safety of self-driving technology a bigger priority.

No Traditional Advertising for Tesla

Unlike other car companies, Tesla does not engage in traditional advertising, which means the Super Bowl ad might reach individuals who are not familiar with the company. Gene Munster, a stock analyst and managing partner of Deepwater Asset Management, stated that although Tesla CEO Elon Musk is a “master of spin,” he would keep moving forward with his plans even if the ad generated bad publicity.

Controversial Self-Driving Technology

Tesla recently released the latest version of its Full Self-Driving technology to around 400,000 people in North America. The technology allows the car to maneuver city and residential streets without human input, but this has renewed questions about its safety. Government investigators are looking into whether Tesla’s driver-assistance features have caused crashes, and a former Tesla engineer has testified that a 2016 demonstration in which the company claimed one of its cars was driving itself was actually staged.

Despite calls for increased oversight over Tesla’s technology, the company continues to push its Full Self-Driving features as a stepping stone towards autonomy. However, the beta version of Full Self-Driving is falling short of its ambitions, with cars repeating the same mistakes they have made for years. Despite software updates, vehicles have been driving down light-rail tracks and suddenly braking for no reason.

Full Self-Driving is part of Tesla’s Autopilot driver-assistance package and costs $15,000. The company has had a rough few months, with its stock price dropping during 2022 due to higher interest rates, concerns about slowing demand, increased competition, and Elon Musk’s chaotic takeover of Twitter.

The Reality

Despite the challenges and distractions, Tesla continues to argue that its Autopilot driver-assistance suite is a safer and better solution than manual driving. The company’s Full Self-Driving technology has been both praised and criticized, and the upcoming Super Bowl ad might further escalate the debate.

Markets

The Most Shorted Stocks as of Late March 2024

DO NOT MISS THIS FREE OPPORTUNITY!

ARE YOU A TRADER?

DO YOU WANT FREE STOCK PICKS?

CHECK THIS OUT….

Ready to elevate your trading game with the next big winner? Don’t miss out – join the savvy investors who are already benefiting from our Wall St veteran’s free SMS alerts. Act now! Sign up at https://slktxt.io/ZmRx or send ‘FREE’ to 844-722-9743 and be the first to get the insider scoop on what’s hot in the market

Short selling is a strategy used by investors who believe that a stock’s price will decline, allowing them to buy it back at a lower price in the future. Market participants closely watch the most shorted stocks as they can be indicative of market sentiment or potential volatility. Based on the latest data from MarketWatch, here are the stocks with the highest short interest as of March 28, 2024.

1. IMAC Holdings Inc. (NASDAQ: BACK)

- Price: $3.30

- 1-Day Change: +6.80%

- Year-To-Date Change: +49.32%

- Short Interest: 880,148 shares

- Percent of Float Shorted: 93.92%

IMAC Holdings stands out with a massive 93.92% of its float being shorted, indicating significant bearish sentiment despite a strong year-to-date performance.

2. XTI Aerospace Inc. (OTC: XTIA)

- Price: $2.86

- 1-Day Change: +5.15%

- Year-To-Date Change: -49.11%

- Short Interest: 381,503 shares

- Percent of Float Shorted: 78.91%

XTI Aerospace has seen nearly 79% of its float shorted amidst a substantial decline in its stock price this year.

3. SunPower Corp. (NASDAQ: SPWR)

- Price: $1.96

- 1-Day Change: -8.41%

- Year-To-Date Change: -59.42%

- Short Interest: 39,254,967 shares

- Percent of Float Shorted: 76.64%

SunPower, a solar energy company, faces skepticism with over three-quarters of its float shorted following a sharp drop in its stock price.

4. BYND Cannasoft Enterprises Inc. (NASDAQ: BCAN)

- Price: $0.97

- 1-Day Change: +6.61%

- Year-To-Date Change: -98.50%

- Short Interest: 410,370 shares

- Percent of Float Shorted: 75.67%

BYND Cannasoft has witnessed an extreme decline in its price this year, coupled with a high short interest.

5. B. Riley Financial Inc. (NASDAQ: RILY)

- Price: $21.72

- 1-Day Change: +0.84%

- Year-To-Date Change: +3.48%

- Short Interest: 12,260,125 shares

- Percent of Float Shorted: 75.47%

B. Riley Financial appears more resilient, showing a positive year-to-date return, yet it still faces significant short pressure.

Other Notable Mentions:

- Biomea Fusion Inc. (NASDAQ: BMEA), Arbor Realty Trust Inc. (NYSE: ABR), and MicroCloud Hologram Inc. (NASDAQ: HOLO) also feature in the top 10 most shorted stocks, with short interests ranging from 41% to 48%.

Analysis:

Investors short sell stocks for various reasons, including speculation on price declines or hedging against potential downturns. The companies listed above are experiencing significant short interest, which could lead to price volatility, particularly if there is a sudden positive shift in their fundamentals, possibly leading to a short squeeze.

It’s essential for investors to conduct thorough research and consider multiple factors when investing in or short selling stocks, especially those with high short interest, as they can be particularly volatile.

Markets

Understanding a Flash Crash in the Stock Market

DO NOT MISS THIS FREE OPPORTUNITY!

ARE YOU A TRADER?

DO YOU WANT FREE STOCK PICKS?

CHECK THIS OUT….

Ready to elevate your trading game with the next big winner? Don’t miss out – join the savvy investors who are already benefiting from our Wall St veteran’s free SMS alerts. Act now! Sign up at https://slktxt.io/ZmRx or send ‘FREE’ to 844-722-9743 and be the first to get the insider scoop on what’s hot in the market

In the fast-paced world of finance, few events can instill as much immediate fear and confusion as a “flash crash.” This term describes an event where stock prices plummet sharply within an extremely short period—often just minutes—before often rebounding just as quickly. These rapid and dramatic movements can result in substantial market disruptions, affecting a wide range of assets including stocks, bonds, and commodities.

Origins of a Flash Crash

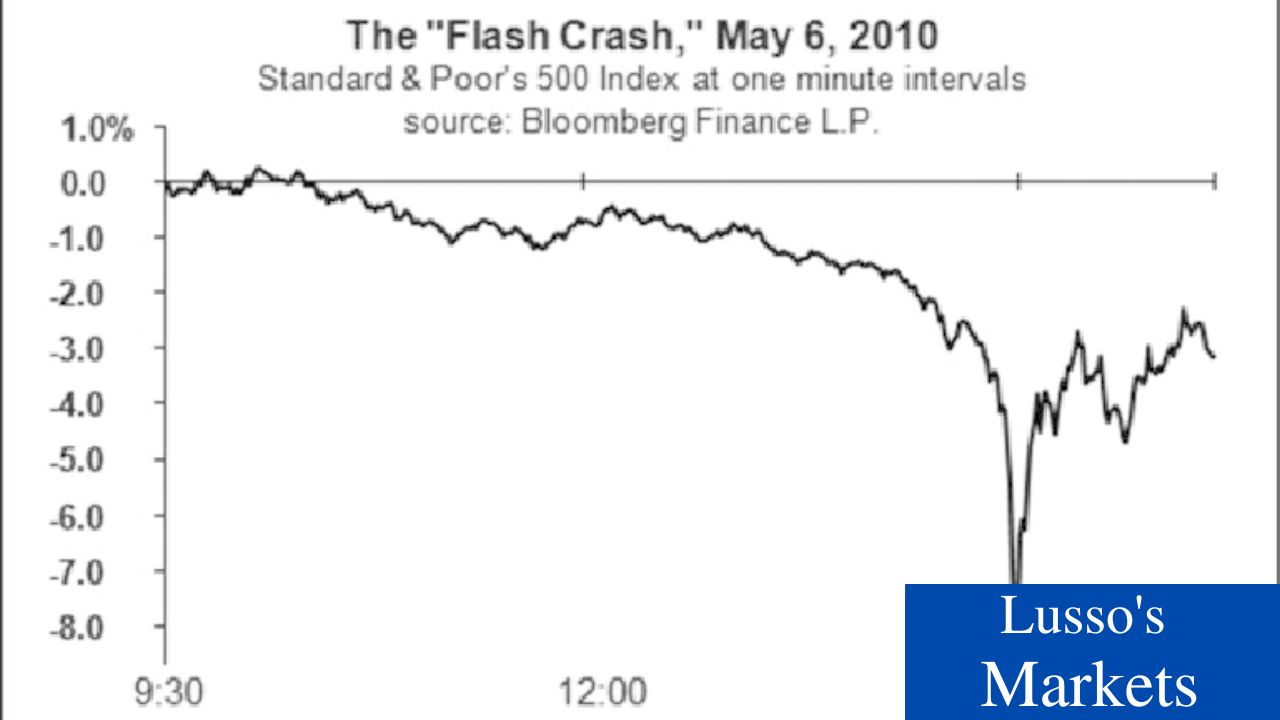

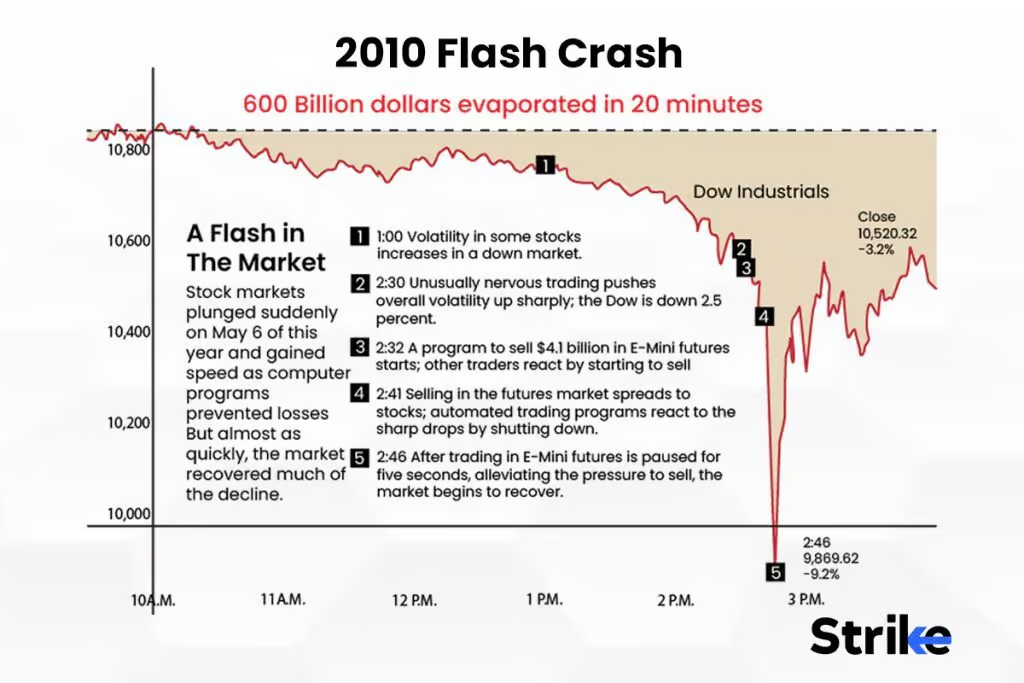

The concept of a flash crash became widely recognized after the most notorious example, which occurred on May 6, 2010. During this event, the Dow Jones Industrial Average fell about 1,000 points (over 9%) only to recover those losses within minutes. This sudden plunge and recovery highlighted inherent vulnerabilities in the market structures and systems.

Causes of Flash Crashes

Flash crashes can be triggered by a variety of factors, which often interact in complex ways:

- High-Frequency Trading (HFT): Many analysts attribute the rise of flash crashes to the increase in high-frequency trading, where firms use algorithms to execute millions of orders at lightning speed. These algorithms can sometimes create feedback loops if they start to sell off assets in a falling market, amplifying the initial decline.

- Market Structure Issues: The fragmentation of trading venues and the varying rules and technologies used by these platforms can also contribute to flash crashes. Disparities in trading rules and protocols can lead to situations where automated systems behave unpredictively or inefficiently.

- Liquidity Crunches: Flash crashes are often exacerbated by a sudden lack of liquidity. As prices begin to fall, automatic stop-loss orders can trigger further selling, but if there aren’t enough buyers, prices can drop precipitously.

- News and Social Media: Sometimes, an erroneous news report or a significant surge in social media activity can spur rapid trading actions by algorithms that parse news and data for trading signals.

Impact and Responses

The impact of a flash crash is broad. In the short term, investors can see huge losses, and confidence in the markets can wane. For traders, the volatility can result in significant financial damage, especially for those who are unable to react quickly enough to the abrupt price changes.

In response to flash crashes, regulatory bodies have implemented several measures to prevent or mitigate their effects. For example, after the 2010 crash, the U.S. Securities and Exchange Commission (SEC) introduced “circuit breakers” that temporarily halt trading in a stock if its price drops too quickly.

Preventative Measures

Beyond regulatory changes, there’s also a push for improved risk management strategies within trading firms, especially those employing high-frequency trading algorithms. These measures include more sophisticated and robust systems to monitor and control trading activities and improved testing of algorithms to ensure they behave as expected during market stress.

The Ever-Evolving Market Dynamics

As markets evolve and the use of technology deepens, the potential for flash crashes remains significant. This necessitates continuous advances in both technology and regulation to safeguard against the risks posed by these rapid and unpredictable market events.

Understanding flash crashes is crucial for anyone involved in the trading world, from regulators and traders to ordinary investors trying to navigate the complexities of modern financial markets. Recognizing the signs and potential triggers of flash crashes can help market participants better prepare for and potentially avoid the risks associated with these startling events.

Markets

A Glimpse Into the Buzz of Upcoming IPOs in April 2024

DO NOT MISS THIS FREE OPPORTUNITY!

ARE YOU A TRADER?

DO YOU WANT FREE STOCK PICKS?

CHECK THIS OUT….

Ready to elevate your trading game with the next big winner? Don’t miss out – join the savvy investors who are already benefiting from our Wall St veteran’s free SMS alerts. Act now! Sign up at https://slktxt.io/ZmRx or send ‘FREE’ to 844-722-9743 and be the first to get the insider scoop on what’s hot in the market

The investment atmosphere is heating up with a series of intriguing initial public offerings (IPOs) set to hit the market in late April 2024. This month features a diverse lineup of companies poised to go public, ranging from technology innovators to international restaurant chains. Here’s a detailed look at some of the most anticipated IPOs.

Tungray Technologies Inc. (TRSG)

Exchange: NASDAQ Capital

Price: $4.00

Shares: 1,250,000

Expected IPO Date: 4/19/2024

Offer Amount: $5,000,000

Tungray Technologies is stepping into the public market with a modest offer amount. The company’s focus on innovative tech solutions might attract investors looking for new growth opportunities in the tech sector.

RanMarine Technology B.V. (RAN)

Exchange: NASDAQ Capital

Price: $5.50

Shares: 1,435,000

Expected IPO Date: 4/19/2024

Offer Amount: $9,076,375

RanMarine Technology, known for its advanced marine technology solutions, is also set for the same date. With a slightly higher offer amount, it shows potential for considerable market interest.

Sushi Ginza Onodera, Inc. (ONDR)

Exchange: NYSE MKT

Price Range: $7.00-$8.00

Shares: 1,066,667

Expected IPO Date: 4/19/2024

Offer Amount: $9,813,336.40

Offering a culinary twist to the IPO scene, Sushi Ginza Onodera is preparing to serve not just premium sushi but also potentially premium stock value.

mF International Ltd (MFI)

Exchange: NASDAQ Capital

Price Range: $4.00-$5.00

Shares: 1,560,000

Expected IPO Date: 4/22/2024

Offer Amount: $8,970,000

This global firm is entering the market with a flexible price range, suggesting a cautious yet optimistic approach towards investor reception.

YY Group Holding Ltd. (YYGH)

Exchange: NASDAQ Capital

Price Range: $4.00-$5.00

Shares: 1,500,000

Expected IPO Date: 4/22/2024

Offer Amount: $8,625,000

YY Group is another promising prospect with its roots in technology and digital transformation, aiming to capture the tech-savvy investor’s eye.

Key Mining Corp. (KMCM)

Exchange: NYSE MKT

Price: $2.25

Shares: 4,444,444

Expected IPO Date: 4/25/2024

Offer Amount: $11,499,999.80

Diving into natural resources, Key Mining is set for a significant offering, indicating robust investor confidence in its mining operations and commodity potential.

Marex Group plc (MRX)

Exchange: NASDAQ Global Select

Price Range: $18.00-$21.00

Shares: 15,384,615

Expected IPO Date: 4/25/2024

Offer Amount: $371,538,447

As one of the heaviest hitters this month, Marex Group plc commands attention with its substantial offer amount, reflecting its established market presence and investor trust.

Rubrik, Inc. (RBRK)

Exchange: NYSE

Price Range: $28.00-$31.00

Shares: 23,000,000

Expected IPO Date: 4/25/2024

Offer Amount: $819,950,000

Rubrik stands out with a massive offer, targeting tech investors interested in data management and cloud services, marking it as one of the blockbuster listings of the month.

Loar Holdings, LLC (LOAR)

Exchange: NYSE

Price Range: $24.00-$26.00

Shares: 11,000,000

Expected IPO Date: 4/26/2024

Offer Amount: $328,900,000

Loar Holdings is geared up to make a significant impact with its sizable offer, highlighting its robust positioning in the manufacturing sector.

ZenaTech, Inc. (ZENA)

Exchange: NASDAQ Capital

Expected IPO Date: 4/30/2024

Offer Amount: $7,100,900

Wrapping up the month, ZenaTech will test waters with a strategic focus on tech innovations, appealing to niche investors keen on cutting-edge technologies.

April 2024 is shaping up to be a dynamic month for the IPO market, showcasing a wide range of sectors and opportunities. Investors are advised to keep an eye on these dates and delve deeper into each company’s prospects before making investment decisions. Each of these companies presents unique opportunities and challenges, marking another exciting chapter in the financial markets.

-

Markets3 months ago

Markets3 months agoUnderstanding Viking Therapeutics’ Position in the Biopharma Sector: A Beginner’s Guide

-

Markets3 months ago

Markets3 months agoThe AI Revolution: How Super Micro Computer (SMCI) Skyrocketed in the Tech Rally

-

Trading3 months ago

Trading3 months ago3 Must-Watch AI Stocks in 2024: Unveiling ShiftPixy, C3.ai, and CXApp’s Market Potential

-

Markets3 months ago

Markets3 months agoMastering the Market: A Guide to the Fundamentals of Value Investing

-

Lusso's Exclusives2 months ago

Lusso's Exclusives2 months agoWall Street Veteran Owns A Crap Ton Of Monday.com Stock [NASDAQ:MNDY]

-

Business3 months ago

Business3 months agoDeciphering HSBC Holdings plc’s Fiscal Landscape: An In-depth Analysis of 2023’s Outcomes

-

Markets3 months ago

Markets3 months agoPlus500 Ltd’s Financial Overview: A Glimpse into 2023’s Performance

-

Markets4 weeks ago

Markets4 weeks agoBoeing’s Proactive Measures Ahead of Whistleblower Hearing

-

Markets2 months ago

Markets2 months ago[BREAKING NEWS] ShiftPixy (PIXY): Poised for Explosive Growth with Strategic Acquisitions and $100 Million Financing

-

Lusso's Exclusives3 months ago

Lusso's Exclusives3 months agoTop Stocks to Watch Tomorrow: LQR, NVDA, SMCI, and HOLO

-

Markets4 weeks ago

Markets4 weeks agoUnitedHealth Group Demonstrates Resilience in Q1 2024 Financial Report